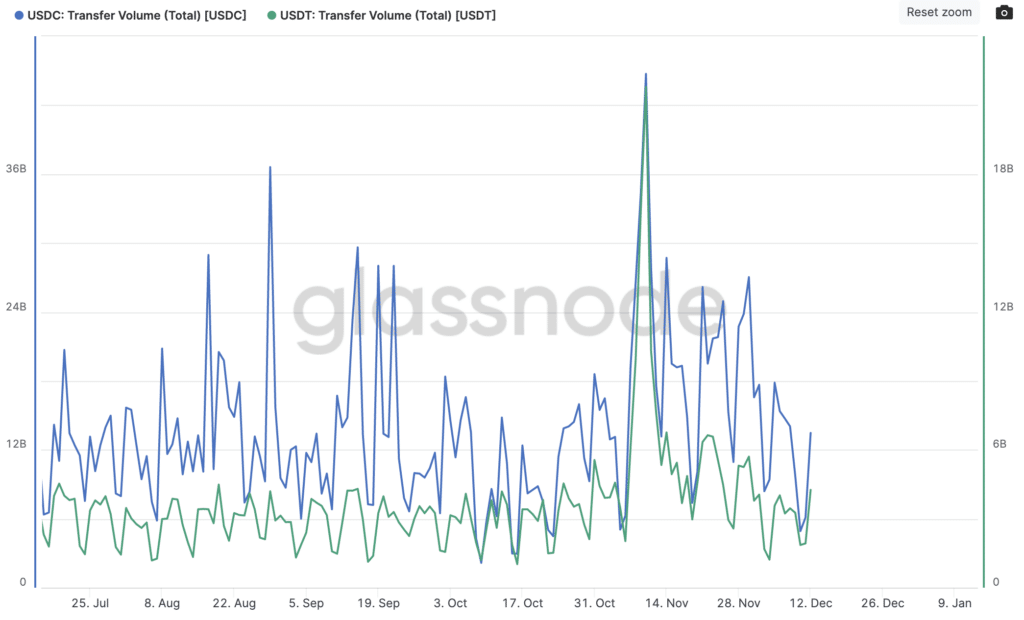

USDC surpasses USDT by transfer volume

From October to January, Circle’s stablecoin USDC surpassed Tether’s USDT in total transfer volume, as stablecoins are widely considered a safe haven amid FTX collapse.

The top stablecoins by market capitalization currently compete with one another in terms of transfer volume. Despite being the most valuable stablecoin in market value and trading volume, USDT has lost out to Circle’s stablecoin in transfers.

Data from Glassnode shows that between October 2022 and January 2023, USDC’s total transfer volumes were over five times more than USDT’s. Shortly after FTX’s demise, there was a notable spike in the newer stablecoin transactions.

Why the USDC gains trust

Some investors feel that USDC is a safer cryptocurrency than USDT. A few elements have influenced this in the blockchain sector related to the two stablecoins.

USDT has had a very troubled background. The stable asset struggled to retain its peg to the dollar in its early years and even attracted arbitrageurs because of this. But it wasn’t even the worst of its issues. Investors frequently required confirmation of reserves.

This proof would be necessary to confirm that the stablecoin issuer, Tether, has the cash required to cover the USDTs issued. Despite the pressure, there was no external audit, which spared USDC from the problem. It was scheduled for 2022 but was postponed again last summer. Still, the company posts regular updates on its reserves on the website.

Circle seems to know how serious the reserves issue is for stablecoin investors. In addition to being a business that focuses on rules and regulations, Grant Thornton, a leading international accounting firm, performs monthly audits for it. The last one published in November 2022 shows that the reserves fully back Circle’s stablecoin.

Tether not disclosing its affiliation with cryptocurrency exchange Bitfinex was another aspect that substantially impacted trust in USDT. Investors would not have had an issue if this information had not been withheld and only came to light after the Paradise Papers release.