5 ways of funding blockchain projects

Discover ways of funding blockchain projects. From bootstrapping to ICOs, learn how to secure funding for your venture and drive success.

Table of Contents

The success or failure of an entrepreneurial venture is closely tied to how much liquidity the startup has. That is no different in the crypto economy. You can develop the most innovative, world-changing technology, but if you run out of funding, you will have to close the shop.

Fortunately, nowadays, several ways to fund your blockchain project do not involve begging your bank for a loan. This article will introduce five popular alternative ways to fund your blockchain venture that could make the difference between your project failing or succeeding.

What is a blockchain fund, and how does it work?

As mentioned above, a blockchain fund is the financial support for projects, startups, or initiatives built on blockchain technology. This funding is important in pushing forward blockchain technology research, development, and adoption.

It usually works by leveraging decentralized networks, smart contracts, and cryptocurrencies to facilitate fundraising and investment activities. Most funding avenues involve some token creation and distribution as well as investor verification in line with know-your-customer (KYC) and anti-money laundering (AML) regulations.

Ways to fund your blockchain project

Funding blockchain projects works in several ways, including bootstrapping, venture capital, crowdfunding, peer-to-peer loans, and initial coin offerings (ICOs).

Let us now take a closer look at each of these blockchain funding methods:

What is bootstrapping?

In the context of blockchain, bootstrapping refers to starting a new project or supporting its initial stages until it becomes self-sustaining from your pocket.

Some feel it is the easiest and most hassle-free way to fund your startup venture, especially if you and your team of developers are in a position to pool your funds together to get the project off the ground.

The benefit of funding your startup is that you have no outside shareholders or private investors to answer to. Furthermore, bootstrapping your project will maintain your share in the company, which may one day be worth a lot of money.

Bootstrapping starts with using personal savings, credit cards, or income from a day job to finance the initial stages of the crypto project. It also prioritizes essential expenses and minimizes unnecessary costs.

Bootstrapped crypto projects operate in a lean manner, staying flexible and adaptable to market changes. They often start with a minimum viable product (MVP) and gather customer feedback to improve over time.

Additionally, they emphasize generating revenue early on to fund further growth and development. This growth is organic through word-of-mouth, referrals, content marketing, and other cost-effective strategies.

As the project grows and generates more revenue, bootstrappers can gradually scale operations, hire additional staff, invest in marketing, or expand product offerings.

What is venture capital?

Venture capital is a form of private equity financing that funds startups and early-stage companies with high growth potential. This type of funding is quite popular in traditional financial circles and is also taking root in the blockchain sector.

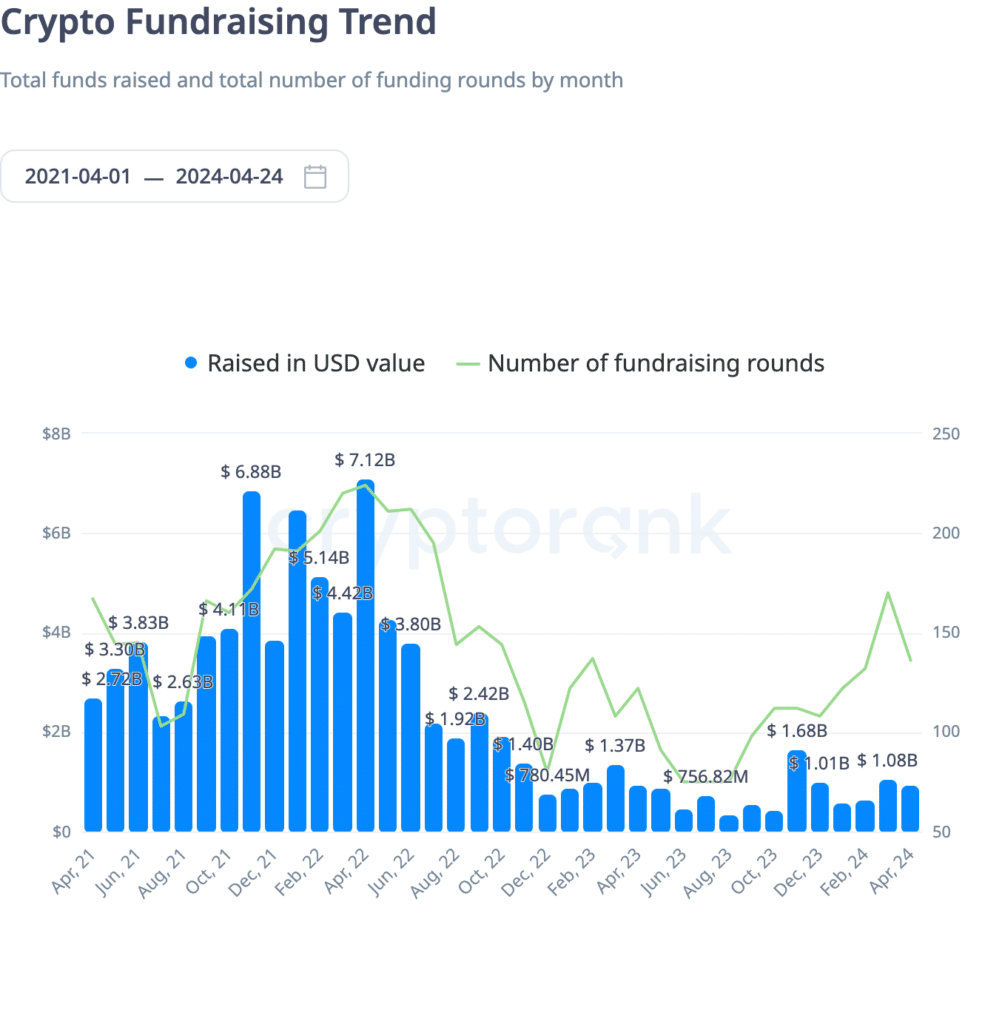

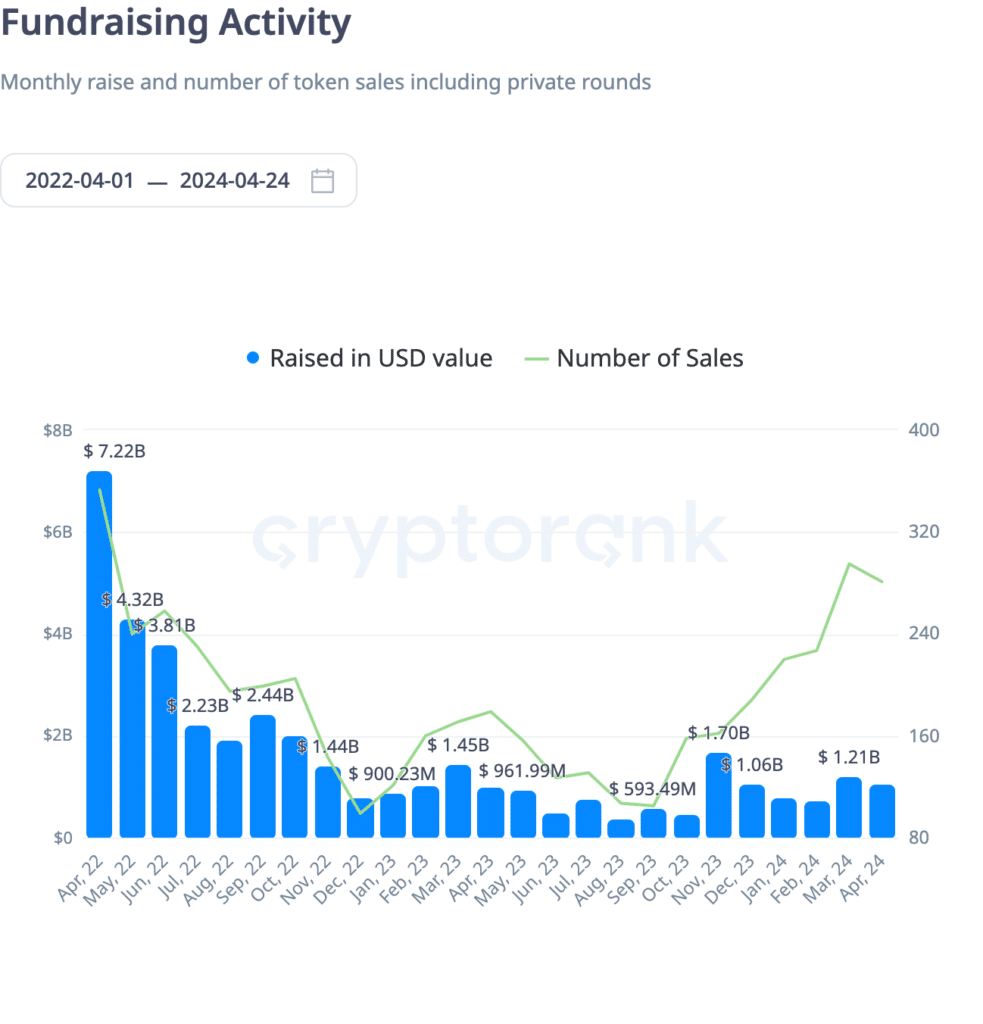

In the last few years, web3 startups have had more access to venture capital funding. For context, in the first quarter of 2022, venture funds raised more than $11 billion for 917 blockchain and crypto projects, according to a Pitchbook report.

There was a downturn in funding in subsequent quarters. This downturn was mainly attributed to a bleak bear market. The downfall of major crypto companies like Terra, Celsius, and FTX also contributed to the slowing down of the crypto VC funding space.

However, Q4 2023 recorded an upsurge in VC funding for crypto projects. It was propelled by the approval of spot Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). Additionally, the emergence of new blockchain use cases, such as real-world asset tokenization and DePIN networks, played a role in this uptick.

Having venture capitalists as investors means you will have to generate a profit sooner rather than later, as investors want to see returns. Also, some VCs like to take a more hands-on approach with their investments, which could mean you, as a founder, may only be calling some of the shots.

VC investors usually assess the potential of a project, its team, technology, and market fit before deciding to invest.

The investment process often broadly follows these steps:

Due diligence: VC firms conduct thorough due diligence on startups. They evaluate the project’s viability, technology, market trends, and competitive landscape.

Investment decision: If the project aligns with their investment thesis, VC firms negotiate terms such as valuation, equity, or token allocation with the startup.

Funding: Once terms are agreed upon, the VC firm provides capital to the crypto startup. In return, they receive equity or tokens.

Support and guidance: Beyond funding, VC firms offer mentorship, strategic advice, and networking opportunities to help the startup grow.

What is crowdfunding?

Crowdfunding is a way for crypto projects to raise funds by collecting small contributions from many people, typically through an online platform. It’s like a digital version of fundraising, where people pool their resources to support ideas or initiatives they believe in.

Unlike traditional venture capital or angel investments, crypto crowdfunding removes the need for a third-party intermediary, allowing direct access to investors.

There are three main types of crowdfunding: reward-based, donation-based, and equity-based.

Rewards-based crowdfunding, as the name suggests, gives back to those who fund the project or startup with rewards. One of the most popular rewards-based crowdfunding platforms is the U.S.-based Kickstarter.

Donation-based crowdfunding is usually found in the non-profit sector and is a way for individuals or NGOs to fund a charitable project they are launching. In the for-profit space, donation-based crowdfunding is relatively rare.

Equity-based crowdfunding gives investors a small share in the company they are funding. Hence, startups can leverage online equity-based crowdfunding platforms such as Crowdfunder, CircleUp, and WeFunder instead of going public to raise money from private investors.

The crowdfunding process generally follows these steps:

Project creation: A person or group with an idea for a crypto project creates a campaign on a crowdfunding platform such as Gitcoin or CoinStarter.

Campaign description: The creator then details the project, including its purpose, goals, timeline, and how the funds will be used. They may also offer rewards or incentives for different contribution levels to encourage people to participate.

Promotion: Next, the campaign creator promotes their crowdfunding campaign through social media, email, word-of-mouth, and other marketing channels to reach a wider audience and attract potential backers.

Contributions: Individuals interested in the crypto project can visit the crowdfunding platform and contribute. These contributions can range from minor to larger sums, depending on the contributor’s interest and financial capacity.

Funding goal: The campaign usually has a target goal representing the amount needed to achieve the project’s objectives. Some platforms use an “all-or-nothing” model, where the project must reach its goal to receive any funds, while others allow flexible funding, where the project gets all contributions regardless of whether the goal is met.

Campaign duration: Crowdfunding campaigns typically run for a set period, such as 30 days or 60 days. During this time, the campaign creator engages with backers, provides updates, and encourages more contributions to reach or exceed the funding goal.

Fund disbursement: If the campaign successfully reaches its funding goal, the crowdfunding platform processes the contributions and disburses the funds to the campaign creator, usually after deducting platform fees. The creator then uses the funds to execute the project as outlined in the campaign.

What are peer-to-peer loans?

Peer-to-peer (P2P) lending, or marketplace lending, is a form of borrowing and lending money directly between individuals or “peers” without involving traditional financial institutions like banks.

It works well for those who do not like giving away a share of their company to outside investors and are comfortable taking on debt to fund their project.

To secure a peer-to-peer loan, you must apply for your funding requirements to be listed on a peer-to-peer lending platform such as LendingClub or Prosper.

Once your funding requirements and terms and conditions are agreed upon by both the startup and the P2P lending platform, the loan is listed, and individual investors can fund it. When the blockchain funding is full, the startup receives the money and repays it plus interest over the loan term in predetermined installments. All payments are handled through the peer-to-peer lending platform.

Peer-to-peer loans are a viable option for those struggling to receive a bank loan, which is the case for many crypto startups, and those who prefer not to give away equity in their new company.

What is an initial coin offering?

Finally, one of the most popular methods of funding a new blockchain project is through an initial coin offering. It is a fundraising method crypto projects use to raise capital by selling digital tokens or coins to investors.

These digital tokens act as an indirect stake in the project and track the startup’s performance. In that sense, ICOs are similar to stock IPOs, with the key difference being that the investors do not hold actual equity in the company. Instead, they hold a digital token that is indirectly linked to the project’s performance.

While launching digital token may seem daunting to some, platforms such as TokenMarket will handle the entire process for you for a fee. This makes fundraising via an ICO accessible to anyone looking to launch a new blockchain project.

To carry out an ICO, you first create a new digital token on a blockchain platform, often using Ethereum’s ERC-20 standard. These tokens represent ownership, utility, or other rights within the project’s ecosystem.

Next, publish a whitepaper detailing your project’s objectives, technology, team, tokenomics, use cases for the token, roadmap, and other relevant information. The whitepaper serves as a prospectus or business plan for potential investors.

After that, announce the token’s ICO, specifying the start and end dates of the token sale, the total supply of tokens, the token price, accepted cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH), and any bonuses or incentives for early investors.

Once that is done, investors interested in your project’s potential can purchase its tokens during the ICO period. They send their contributions in cryptocurrencies to the project’s designated wallet address provided by the ICO.

After the ICO concludes, the project will distribute the purchased tokens to investors’ wallets based on the amount of cryptocurrency they contributed and the token allocation specified in the ICO terms.

The project can then use the raised funds to develop and implement its platform, technology, or services as outlined in the whitepaper. Token holders may participate in the project’s ecosystem, access services, receive rewards, or engage in governance activities, depending on the token’s utility.

Once the ICO is completed and tokens are distributed, the project may seek to list its tokens on crypto exchanges, allowing holders to trade their tokens and provide liquidity while potentially increasing its value based on market demand.

Final thoughts on funding blockchain

Funding blockchain projects is crucial for their success, as liquidity is vital in sustaining entrepreneurial ventures, especially in the crypto economy.

Whether through bootstrapping, venture capital, crowdfunding, peer-to-peer loans, or ICOs, each funding method offers unique advantages and considerations.

Bootstrapping provides independence but requires a personal financial commitment and strategic resource allocation. Venture capital brings expertise and resources but may involve relinquishing some control and meeting profit expectations.

On its part, crowdfunding democratizes funding but requires effective marketing and engagement with backers, while peer-to-peer loans offer alternative financing without equity dilution but necessitate timely repayments. ICOs enable widespread investment but demand comprehensive planning and compliance.

Choosing the right funding approach depends on your project goals, resources, and risk appetite. You will also need to carry out in-depth research into all possible avenues for bankrolling your crypto project to find what best suits your needs.