Wrapped Ethereum (WETH): Increasing Interoperability of Ethereum

Wrapped Ethereum (WETH), a tokenized version of Ethereum, contributes to reaching higher interoperability and integration with other blockchains as well as promoting the ETH use in dApps.

What Is WETH?

Wrapped coins are highly popular among blockchain users because they provide higher flexibility in terms of using specific cryptocurrencies when interacting with other blockchains. WETH maintains its peg to Ethereum, while enabling users to apply the equivalent of ETH to other blockchains. On the one hand, ETH holders become able to use on Bitcoin, Avalanche, or other blockchains. Even the limitation of Ethereum being incompatible with the ERC-20 standard can be successfully overcome, thus, maximizing its value for DeFi users. On the other hand, WETH can be easily converted to ETH at any moment at the rate of 1:1 as collateral held allows providing the required liquidity to all stakeholders. WETH can also be helpful for users in cases when gas fees tend to rise rapidly, while other blockchains such as Avalanche may provide similar functionality at lower fees.

As WETH is pegged to ETH, their market prices follow the same trends. At the moment, the WETH price equals $1,481 with the total supply of 1.15 million tokens. WETH is ranked as the 2,769th at the moment, although CoinMarketCap reports the rapid increase in users’ interest in this token in the past several days. Ethereum’s ability to restore its market potential also contributes to the growing demand for WETH as the expectations for higher seers’ activity and interoperability proportionally increase. The last month is characterized by the rapid restoration of WETH’s price, increasing the likelihood of a new bullish cycle in the following weeks.

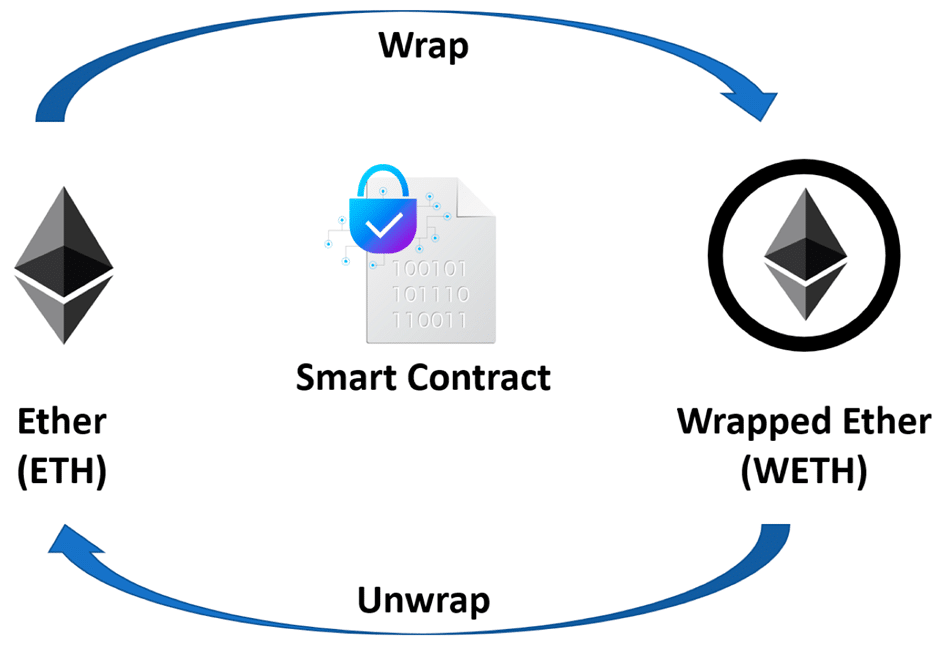

Figure 1. WETH Operational Scheme. Data Source – MDPI

WETH Market Potential

The long-term demand for WETH will largely depend on the following major factors: Ethereum’s successful transition to Ethereum 2.0 by September as recently announced; the rates of the crypto market’s restoration; competitive positions of other blockchains, including their ability to maintain low transaction fees; and interoperability trends. Overall, WETH has a considerable market potential to significantly improve its ranking among the top-cryptocurrencies, especially in case the crypto winter will end in the near future. As a result, the demand for dApps and interoperability solutions may increase proportionally. The success and popularity of WBTC also confirms the high likelihood of similar tendencies for WETH.

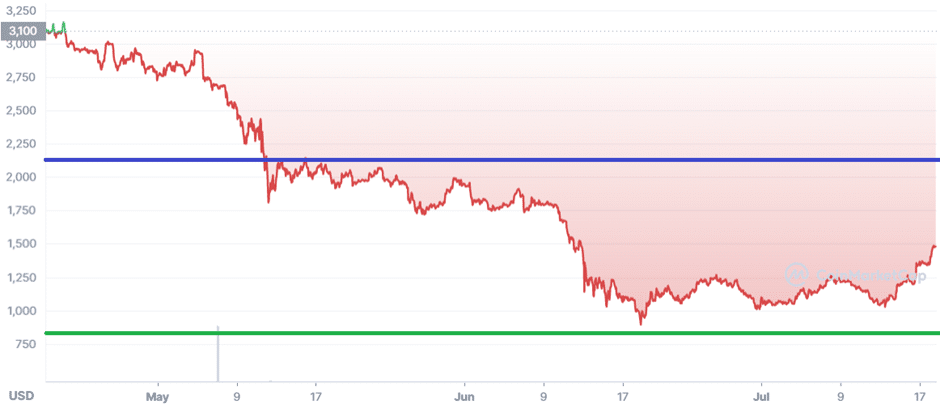

Figure 2. WETH/USD (3-Months); Data Source – CoinMarketCap

The WETH price dynamics reflects the ETH price trends, including the major support and resistance levels. At the moment, WETH demonstrates the transition from consolidation to the moderate restoration of its past positions. The major support level is at the price of $800 that prevents Ethereum’s holders from capitulating. Moreover, the psychological level of $1,000 also appears to be significant for most traders. The major resistance level is about at the price of $2,200 that prevents ETH and WETH from appreciating to local maximums. The rapid increase in Ethereum’s capitalization and market activity are crucial for stimulating the demand for WETH, thus, contributing to correspondingly affecting the overall structure of crypto market operations in this segment.