Bitcoin’s Average Transaction Fee Decline to Lowest Level in 7 Years

Bitcoin transaction fees are at their lowest level since 2011. The lower fees follow on from bitcoin fees rising as high as $50 per transaction at the end of 2017, a situation that did not have much economic viability.

Consider that the basic premise of blockchain technology is to enable faster and cost-effective transactions. If PayPal and other mainstream payment processing charge between one to four percent per transaction, and bitcoin transactions are as high as $50, it erodes whatever economic superiority bitcoin transactions could have over other mainstream payment processing for all small payments.

2018, however, has not been favorable as things do not seem to look up for the premier cryptocurrency. Lately, it has been struggling in the past three months as high transaction fees and time involved with bitcoin have been one of the most significant hurdles in the adoption of the cryptocurrency as a medium of exchange.

Several cryptocurrencies have sprung up, claiming to provide a solution to the bitcoin problem, but many of them have been unsuccessful. Bitcoin transaction fees have fallen this year, and the good news is that the median transaction fee for bitcoin is currently at an all-time low since 2011.

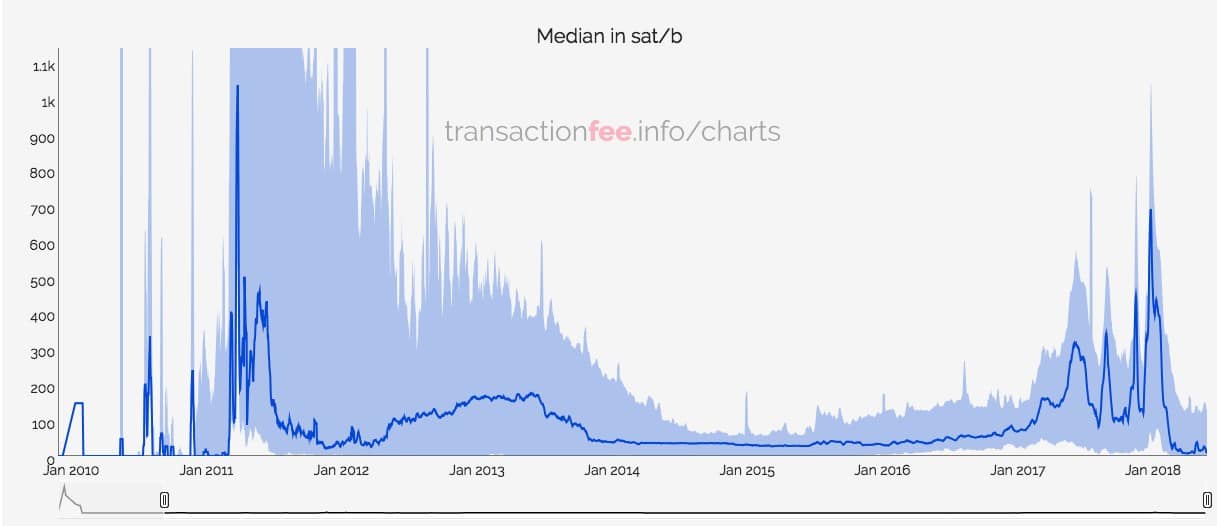

Low sat/Bytes Median Fee

The median transaction fees for bitcoin hit the lowest on April 4 and 5, 2018, at 6.86 satoshi/bytes (sat/B). The fee rate later increased to 39.29 sat/B on April 30, 2018, but this did not last long, as it has since come down again.

The transaction fee rate came under ten sat/B again on May 26, 2018 (9.43 sat/B) and closed at 8.86 sat/B on May 27, 2018, which is a quite a decline from the beginning of this year. The transaction fee rate was 453.57 sat/B over the New Year’s.

Source: Transactionfee.info

The low fee rates show that it is becoming cheaper to transfer bitcoin among different wallets. The high cost and time involved in bitcoin transactions led to the split of Bitcoin’s blockchain, thereby creating bitcoin cash with a bigger block size.

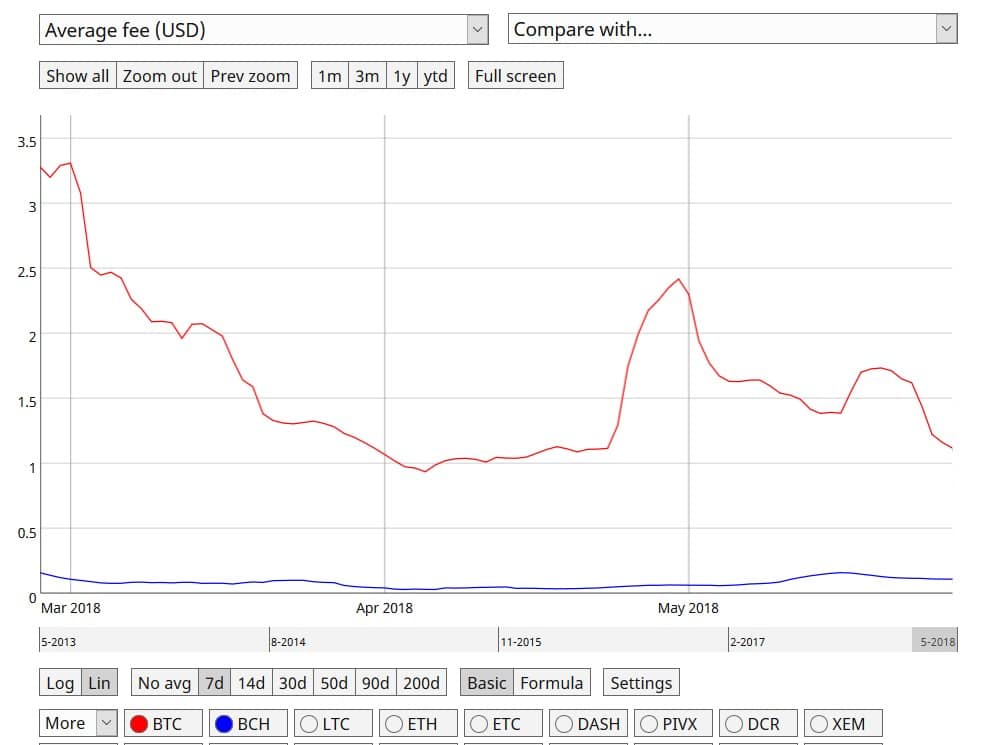

Fees Converge with Bitcoin Cash’s

The median transaction fee rate was overbearing initially, but the gap seems to have closed to negligible in the past three months.

Initially, the median transaction fee rate was $34.095 for bitcoin, while bitcoin cash was $0.0333. But the figures changed on Sunday, May 27, as the median fee rate was a paltry $0.113 compared to the $0.0038 for bitcoin cash.

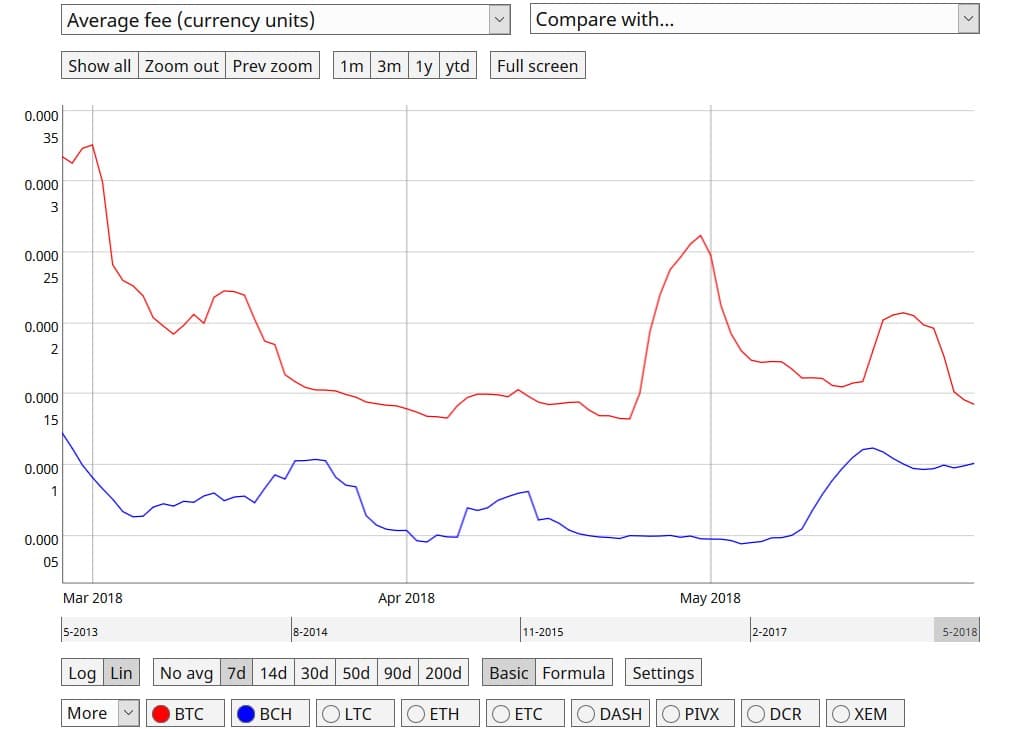

The two charts below show the fees in U.S. Dollars and the respective currency units, with the data pulled from Coinmetrics.

7-day rolling average of Bitcoin and Bitcoin Cash fees (U.S. Dollars). Source: Coinmetrics

7-day rolling average of Bitcoin and Bitcoin Cash fees (currency units). Source: Coinmetrics

Segregated Witness (SegWit) To the Rescue?

Segregated Witness, or SegWit as it is commonly called, is a Bitcoin soft fork, was activated on August 24, 2017, to solve transaction malleability, thereby enabling the Lightning Network. In October 2017, the proportion of network transactions using SegWit rose from seven to ten percent.

SegWit has seen an increased adoption, and this could explain the reduced Bitcoin transaction fee. While only 28.34 percent of all transactions where utilizing SegWit, the number rose to 38 percent on Sunday, May 27. The SegWit transaction fees are lower, they amount to only 18 percent of the total transaction costs, despite contributing 38 percent of the total transaction volume.

Conclusion

As SegWit and Lightning Network (LN) are continually adopted, Bitcoin’s scalability problems are most likely to resolve. While Lightning Network, which seeks to solve Bitcoin’s scalability problem with faster and cheaper transactions, is still in its beginning stages, its development has been very impressive.

The LN network capacity crossed $150,000 in April 2018, and near-instant successful transactions have already been made through the network. When reduced costs and time characterize Bitcoin transactions, it may finally be viable to buy coffee and doughnuts.