Coinbase shares hit all-time low amid projected revenue drop

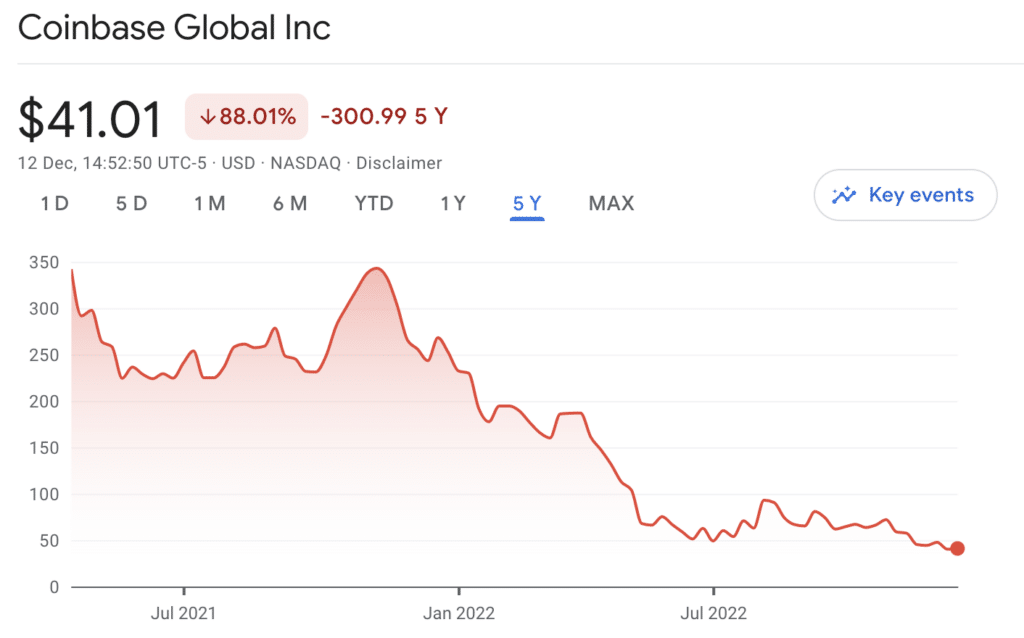

Shares of Coinbase, a US-based crypto platform trading on Nasdaq under ticker COIN, reached an all-time low of $40.2 amid Brian Armstrong’s projection of a revenue drop.

Last week, CEO Brian Armstrong said he anticipated Coinbase 2022 earnings to be lower than half the 2021 revenue. The market reacted in a drop that led to an all-time low on Dec. 12.

The price lost 60% since August when Coinbase stock saw a brief surge after announcing a collaboration with BlackRock. The latter partnered with Coinbase Prime to provide institutional investors with access to BTC custody and trading via its Aladdin platform.

Coinbase shares lost 86% since its IPO in April 2021. It has been among the companies forced to lay off staff this year, losing around 18% of personnel along with OpenSea (21%) and Kraken (32%).

Ark Invest acquires Coinbase shares despite the bear market

However, Ark Invest, led by Cathie Wood, appears keen to catch knives amidst the commotion as a crypto-bullish company. The technology-oriented money manager purchased 78,962 COIN shares at around $40 each, worth around $3 million in total.

Following the purchase, Ark Invest’s stake in Coinbase comprised 5.6 million shares held by it.