Crypto market 2022-2023: from dizzying heights to cautionary tales

Explore the tumultuous journey of cryptocurrencies from 2022’s crashes to 2023’s cautious optimism amidst market volatility and regulatory shifts.

Since their inception, crypto assets have been commanding headlines, with their volatile nature painting a breathtaking, yet sometimes terrifying, picture for investors worldwide.

However, beneath this market’s faсade of extreme ups and downs lies an intricate tapestry woven by factors far beyond just numbers on a screen.

Are they simply victims of their inherent boom-and-bust cycles, or do they bear the brunt of regulatory overreach?

Boom and bust cycles in crypto industry

The cryptocurrency landscape of 2022 was a whirlwind. Tokens like Celsius (CEL) and Terra (LUNC) reached dizzying heights, riding the wave of investor optimism.

However, as these digital entities crumbled into obscurity, they symbolized the turbulent nature of the crypto markets.

The fall of the Celsius Network was dramatic, as it suspended all operations, leading to bankruptcy, and its token’s value collapsed to a mere $0.16, marking a 98% drop from its all-time high of $8.02.

Similarly, Terra’s native token, LUNA, experienced a downfall, triggering accusations of defrauding investors against Terraform Labs’ chief, Do Kwon, and leading to a desperate rebranding attempt.

These incidents led to a major dent in investor confidence, fostering an air of caution around the crypto industry. Yet, it’s critical to remember that these boom and bust cycles are not unique to digital assets.

From the gold rush to the dot-com bubble, history is littered with similar euphoric highs followed by sobering corrections. They are simply part of the evolution of any new market, a sign of growing pains as they chart a course toward maturity.

Crypto market in 2023

As 2023 has just ended, it appears that the lessons from the past year have not been in vain. A sense of cautious optimism pervades the crypto market. Despite the trials and tribulations of the previous year, the market has picked itself up, dusted off the debris of the past, and is once again charging forward.

As of Jan. 12, the market was rallying, with Bitcoin (BTC) and Ethereum (ETH) reaching local peaks at $48,900 and $2,690, respectively. The major assets’ price was affected by the long-awaited Bitcoin ETF approval.

BTC has impressively gained around 105% year-to-date (YTD), trading at a robust $42,896. ETH, too, has seen an approximate 64% gain YTD, trading at $2,534.

The overall market cap, a key indicator of the industry’s health, is also experiencing an upward movement. Despite the adversities faced, the resilience of this market underlines the potential that cryptocurrencies hold for the future of finance.

The crypto market’s fluctuating trajectory from the challenges of 2022 to the developments in 2023 showcases its ever-changing nature.

This growth and decline cycle indicates the market’s ongoing transformation, suggesting a future shaped by new developments, cooperative efforts, and an ongoing shift toward decentralization.

Inherent crypto volatility: reasons and implications

The crypto-verse has always been synonymous with volatility. Its spectacular swings between bearish slumps and bullish runs can be as daunting as exciting. This inherent volatility, while unsettling for some, is a function of many factors that set cryptocurrencies apart from traditional markets.

Firstly, the crypto market is still relatively young and more susceptible to large price swings. In contrast to traditional financial markets that have been around for centuries, cryptocurrencies have just over a decade under their belt.

This relative infancy and a limited market size lead to greater price sensitivity. In simple terms, a comparatively smaller trade volume can result in substantial price shifts. Secondly, the crypto market operates 24/7 across the globe, devoid of traditional trading hours. This continuous operation means news or events can trigger immediate reactions, causing sharp price fluctuations at any given time.

Furthermore, speculation plays a significant role in this market. Due to the lack of established methods to assess the “fair value” of these digital assets, prices are largely driven by investor sentiment. It can swing dramatically in response to factors ranging from regulatory news and technological advancements to macroeconomic trends.

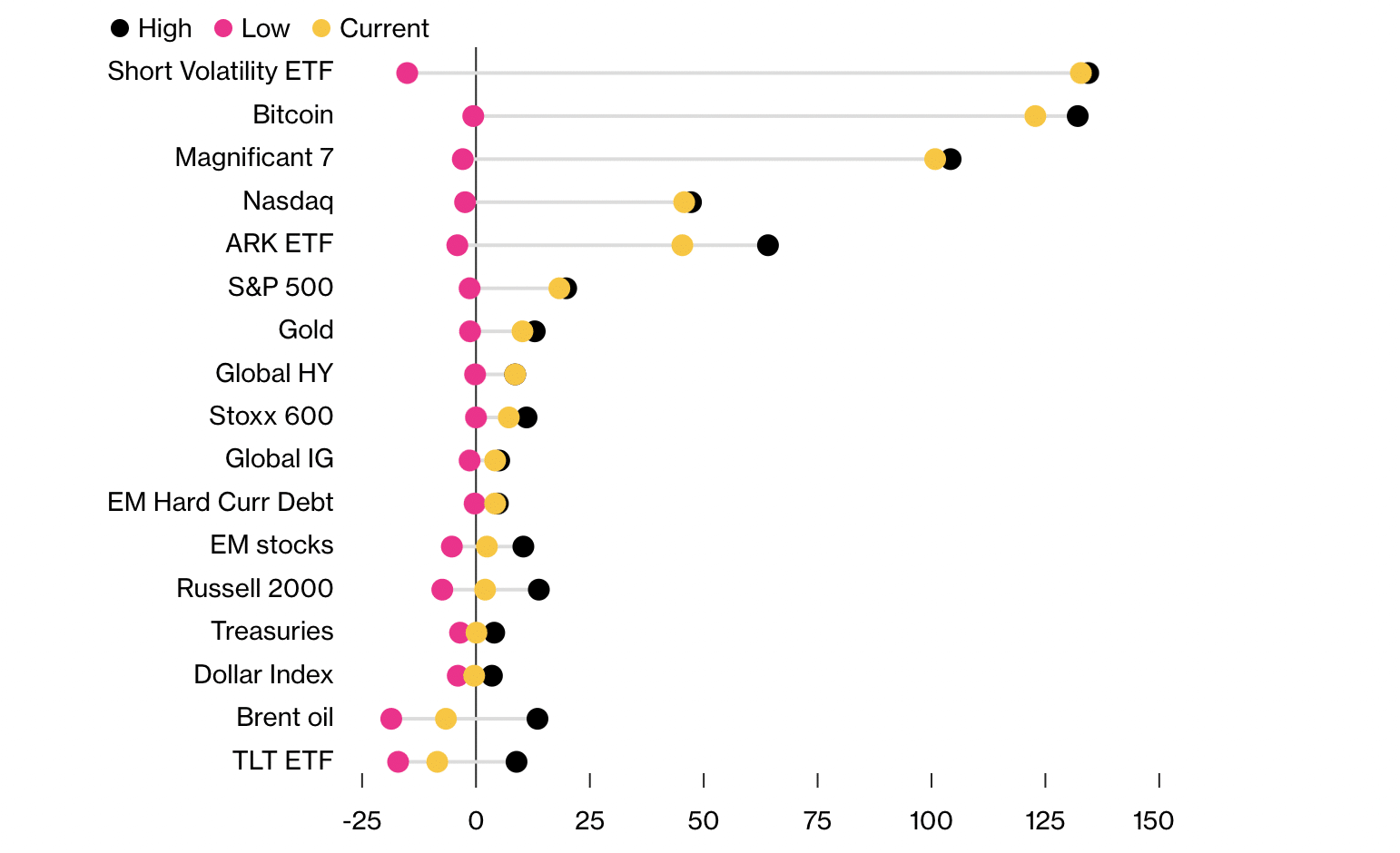

While these factors contribute to market instability, the 2023 experience has shown that such volatility also presents opportunities. According to Bloomberg, Bitcoin leads this year’s performance chart that includes traditional assets, fiat and crypto.

The unexpected market trends of 2023 contrasting sharply with the predictions made at the end of the previous year. Per Bloomberg, while experts anticipated a challenging year for high-risk assets due to rising interest rates, looming recession, and persistent high inflation, the reality proved quite different. Risky market segments, surprisingly, yielded the most significant returns.

One of the most lucrative investments was betting against stock market volatility, which saw a staggering 150% return. Bitcoin also emerged as an unexpectedly profitable investment, followed closely by shares in major tech firms, which typically react negatively to interest rate hikes.

Traditional investments like the U.S. S&P 500 and gold also performed well, with gains of 19% and 10%, respectively. However, the slowing economy adversely affected oil prices, marking their worst performance since the 2020 pandemic. Long-term U.S. Treasuries also suffered significant losses.

Looking ahead to 2024, market analysts expect the trend of risk-taking to continue, with equities likely outperforming bonds. However, much depends on the nature of the economic recession, whether it will be mild and short-lived, potentially leading to more accurate forecasts this time around.

Сrypto industry and regulatory overreach

The cryptocurrency industry’s interactions with regulatory bodies, especially in the United States, have been fraught with contention and uncertainty.

As the new year unfolds, analysts predict an increase in regulatory actions in the crypto space, particularly concerning anti-money laundering, counter-terrorist financing risks, and the conduct of companies operating in the sector.

In the United States, regulatory actions are intensifying, with the SEC and CFTC using existing legal structures to regulate digital asset activities. Over 200 enforcement proceedings were initiated against crypto firms in 2023. Despite calls for clearer crypto laws, the SEC has maintained a stringent approach, as evidenced by its recent denial of Coinbase’s petition for new crypto sector rules.

The appointment of Gary Gensler as the SEC chairperson marked a period of increased scrutiny of the cryptocurrency industry. Gensler, likening the crypto world to the “Wild West,” has made clear his intent to regulate it more strictly, believing most cryptocurrencies to be securities.

The European Union is set to enact comprehensive laws governing the crypto sector in 2024, with the Markets in Crypto Assets Regulation (MiCA) aiming to establish uniform EU crypto regulation. This move is expected to provide legal certainty for digital assets beyond current financial services legislation.

In the UK, crypto companies must register with the Financial Conduct Authority (FCA) and comply with specific regulations. The government also wants to regulate a broader range of digital assets and align crypto promotions with financial advertising standards.

Asia presents a varied regulatory landscape. While China has banned crypto use, Singapore and Hong Kong are adopting more welcoming approaches, with Singapore introducing rules to protect individual traders and Hong Kong establishing a comprehensive regulatory framework.

Globally, over 40 jurisdictions have some form of crypto regulations, with countries like Australia and the UAE actively developing comprehensive frameworks. The article also touches on the potential impact of the 2024 election season on digital asset legislation in the U.S. and the increasing importance of Bitcoin ETFs.

Experts predict that upcoming regulations will refine measures to foster a robust and sustainable crypto market. They foresee uniform anti-money laundering policies across the EU and anticipate changes in other parts of the world, like Indonesia and India, towards a more crypto-friendly stance.

This notion contrasts starkly with crypto firms’ perspective, which argue that they are designed to operate outside the traditional financial system. Moreover, the tension between regulatory bodies and the crypto industry largely stems from a lack of consensus over cryptocurrencies’ classification. Are they securities, commodities, or neither?

This confusion has led to a smoother regulatory landscape. In the words of Charles Elson, a corporate governance chair at the University of Delaware:

“Federal agencies always seek to expand their scope of jurisdiction, so the SEC would like to call these things securities, and going after the exchanges is one way to stake out their claim.”

Charles Elson, a corporate governance chair at the University of Delaware

The current lawsuits against Binance and Coinbase don’t resolve this debate but push the industry closer to a definitive regulatory framework. While Gensler has made his perspective clear, stating, “we don’t need more digital currency … we already have digital currency — it’s called the U.S. dollar,” this viewpoint is far from universal.

According to recent research, approximately 14% of the U.S. population owns crypto investments. Despite the SEC’s actions and Gensler’s comments, the crypto market’s ongoing boom and widespread belief in digital currencies’ potential suggest that the demand for crypto investments will persist.

Regulatory oversight impact on crypto market

Increased regulatory scrutiny in the crypto industry is impacting more than just the companies facing lawsuits or investigations. Heavy regulation is seen as a barrier to progress in a sector that relies on innovation and risk-taking. This constant legal pressure can limit creativity and deter new entrepreneurs from entering the crypto market.

Startups, which are crucial for the sector’s growth, might be reluctant to join an industry clouded by regulatory uncertainty. This hesitation can slow down the industry’s development and innovation. Additionally, regulatory actions can create fear among investors, both retail and institutional, leading to market volatility and sell-offs.

The industry’s reputation is also affected by high-profile legal cases and accusations of malpractice, reinforcing a perception of the crypto market as unregulated and risky. This negative image can discourage investment and hinder mainstream acceptance.

For crypto companies, complying with regulations demands significant resources, which could otherwise be used for innovation. This compliance burden is especially challenging for smaller companies and can create an uneven playing field that favors larger, established entities.

While regulation is necessary to prevent fraud and protect investors, the current extent and nature of these regulations could suppress innovation and growth in the crypto industry. The future of the sector will depend on how well regulators and crypto businesses can navigate this complex environment.

Potential scenarios for crypto industry in 2024

As we enter 2024, the crypto industry is set to undergo further transformations shaped by a confluence of technological advancements, evolving regulations, and market dynamics.

Regulatory clarity

The ongoing saga of regulatory scrutiny is likely to reach a pivotal point soon. We may see comprehensive crypto-specific regulations that could define the industry’s trajectory for years.

Regulatory clarity can boost investor confidence, reduce the fear of sudden policy shifts, and, in turn, reduce the likelihood of severe boom-bust cycles.

Technological innovation

Crypto and blockchain technology continue to evolve rapidly, with an ever-increasing number of use cases and applications across various sectors.

This could drive the next boom phase, with new innovative tokens, such as artificial intelligence (AI) tokens, capturing investor interest and traditional cryptocurrencies cementing their market positions.

Mainstream adoption

As regulatory and technological issues resolve, we can expect increased mainstream adoption of cryptocurrencies. This could involve greater acceptance of crypto as a form of payment, wider use of blockchain technology, and more institutional investment. This would likely add stability to the industry, dampening the severity of boom-bust cycles.

Asset diversification

Diversification within the crypto space is also expected to increase. As more sophisticated financial products such as ETFs and futures contracts become prevalent, investors may be able to better manage risk and potentially reduce the impact of the industry’s notorious volatility.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.