Is the ETH ETF launch a ‘sell the news’ scenario?

Spot Ethereum exchange-traded funds are set to debut on July 23, following the SEC’s rule change over two months ago.

According to a report by Kaiko, the initial inflows to these ETFs will most likely affect Ethereum’s (ETH) price. However, whether the effect will be positive or negative is still up for grabs.

“The launch of the futures based ETH ETFs in the US late last year was met with underwhelming demand, all eyes are on the spot ETFs’ launch with high hopes on quick asset accumulation. Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days.”

Will Cai, head of indices at Kaiko

Several Ethereum ETFs from BlackRock, Fidelity, Bitwise, VanEck, 21Shares, Invesco, Franklin Templeton, and Grayscale are scheduled to start trading on July 23.

The influx of money could cause ETH to surge even though last year, futures-based ETH ETFs received a lukewarm reception. There is cautious optimism about spot ETFs’ asset accumulation and how it could reflect the price of ETH.

ETH prices briefly spiked in May following spot ETF approval but have since trended lower. At $3,500, ETH is facing a crucial supply wall.

Grayscale’s ETH ETF fees

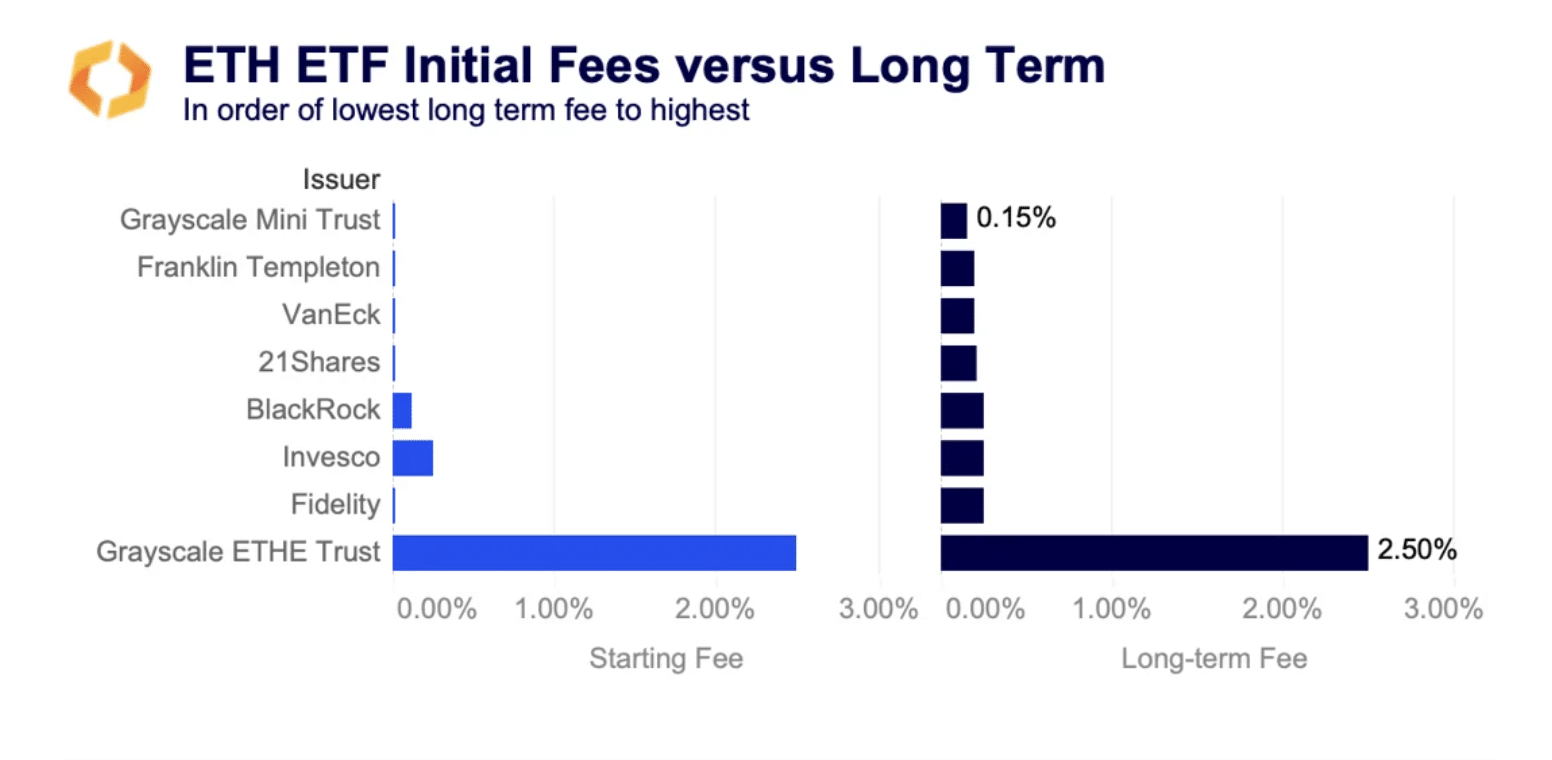

Grayscale, a prominent crypto player, plans to convert its ETHE trust into a spot ETF and introduce a mini trust seeded with $1 billion from the original fund. Grayscale’s ETHE fee will remain 2.5%, much higher than its competitors.

Most issuers will offer fee waivers to attract investors, with some waiving fees for six months to a year or until assets reach between $500 million and $2.5 billion. This fee war reflects the fierce competition in the ETF market, leading ARK Invest to exit the ETH ETF race.

This echoes Grayscale’s Bitcoin (BTC) ETF strategy, where they maintained high fees despite competitive pressures and sell-offs.

According to Kaiko, Grayscale’s decision to keep its fees high might lead to ETF outflows, leading to sell-off prices, similar to the post-conversion performance of its GBTC.

The ETHE discount to net asset value has recently narrowed, indicating traders’ interest in buying ETHE below par to redeem at net asset value post-conversion for profits.

ETH ETF volatility

Additionally, implied volatility for ETH has surged over the past few weeks due to a failed assassination attempt on Donald Trump and President Joe Biden’s announcement that he won’t run for president again. This reflects traders’ nervousness about the upcoming ETF launch.

According to Kaiko, contracts expiring in late July experienced a rise in volatility from 59% to 67%, indicating the market’s anticipation and potential price sensitivity to initial inflow numbers.