Institutional adoption of crypto is growing. What can boost it further?

Institutional interest in cryptocurrencies is rising, as revealed by a recent Coinbase survey. What is happening, and what is causing the surge?

Over the years, the crypto market has seen a shift towards institutional adoption of digital assets, signaling a phase where crypto assets are getting increasingly integrated into the broader financial ecosystem.

A survey conducted by Coinbase in Nov. 2023 revealed that institutional interest in crypto investments is on the rise. About one-third of respondents increased their crypto holdings over the past year, while only 17% decreased them. Half of the respondents kept their crypto investments unchanged.

Their findings also revealed that 64% of those already invested in crypto anticipate that their firm’s allocations will increase over the next three years. Interestingly, none of the respondents expected a decrease in their allocations during this period.

So, what do these findings mean for the crypto market, and what are the key takeaways regarding institutional adoption in crypto?

Institutional adoption trends and highlights

Institutional adoption of crypto is hitting milestones, showing how digital assets are becoming more integrated into finance. Let’s delve into the major trends and updates.

Spot BTC ETF approvals and prospects for ETH ETFs

The approval of 11 spot Bitcoin (BTC) ETFs by the U.S. SEC came as a historic decision after years of anticipation and several applications from major financial institutions.

Among the approved ETFs are those by notable financial giants such as Grayscale, Fidelity, and BlackRock, signaling strong institutional backing in providing regulated Bitcoin investment vehicles to a broader audience.

Furthermore, the establishment of these ETFs on major U.S. exchanges enhances the legitimacy and perceived stability of Bitcoin as an asset class, potentially leading to increased adoption by both retail and institutional investors.

Within just a month, these ETFs have amassed over $25 billion in collective assets under management (AUM), according to data from Blockworks.

The SEC’s decision also sets a precedent for the approval of other cryptocurrency-based financial products, including those tied to other digital assets like Ethereum (ETH).

In a SEC filing from Feb. 6, it’s revealed that the regulatory body has postponed its decision on a proposed product by Invesco and Galaxy Digital, major players in asset management and crypto, respectively.

This delay isn’t isolated. Throughout the years, the SEC has been pushing back decisions on various spot Ethereum ETF applications. Notable names like BlackRock and Fidelity are among the firms awaiting approval.

Bloomberg analyst James Seyffart suggests the SEC will initially reject spot Ethereum ETFs but may ultimately approve them by the May 23 deadline this year.

The ETF trend suggests wider recognition and adoption of cryptocurrencies within institutional circles, potentially paving the way for broader acceptance and investment in the digital asset space.

JP Morgan’s programmable payments

In Nov. 2023, JPMorgan Chase introduced a new function for its blockchain platform, JPM Coin, aimed at its institutional clients. This function, known as programmable payments, allows users to automate and execute financial transactions based on specific conditions, offering a flexible approach to managing payments and treasury functions.

The essence of programmable payments lies in their use of smart contracts to automate transaction processes. This means that transactions can be set to occur automatically when certain predefined conditions are met, such as reaching a certain date or fulfilling a contractual term.

For example, Siemens AG, a multinational company, became one of the first to use this feature, indicating its practical value for large corporations.

Canton Network by Goldman Sachs and others

In May 2023, a consortium led by thirty prominent financial institutions, including Goldman Sachs, Microsoft, BNP Paribas, Deloitte, and others, announced the launch of the Canton Network.

The Canton Network is designed as an interoperable blockchain “network of networks,” facilitating the tokenization of real-world assets (RWAs) using Digital Asset’s DAML language.

The importance of the Canton Network lies in its focus on RWAs, which include a wide range of assets, from traditional financial instruments to physical assets that can be digitally represented on a blockchain.

By providing a standardized mechanism for the representation of real-world assets on a blockchain, it opens up new possibilities for asset owners, investors, and financial service providers.

These possibilities include more accessible investment opportunities, enhanced liquidity, and the potential for creating more dynamic and responsive financial products.

How can crypto gain more institutional adoption?

The factors leading to more institutions adopting crypto and blockchain in 2024 are multifaceted. Let’s understand them one by one:

Tech innovations

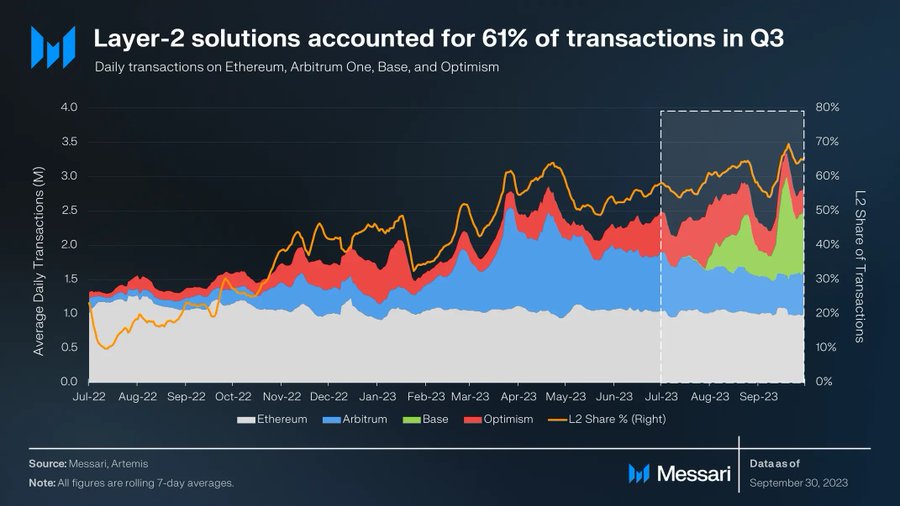

The advancement of blockchain, particularly through developing and adopting layer-2 scaling solutions and modular blockchains, is a crucial factor in the tech landscape.

Layer-2 solutions, which aim to enhance scalability, efficiency, and cost-effectiveness, experienced notable growth in 2023.

This progression towards specialized blockchain infrastructures—tailored by sector or function—could increase blockchain’s appeal for institutional applications, resulting in newer applications and use cases.

Regulatory developments

2023 witnessed significant strides towards regulation, highlighted by the UK government and the European Union announcing plans to enact extensive legislation governing crypto activities.

The continuation of this trend in 2024 is expected to bring about further regulations, enhancing clarity and potentially boosting institutional adoption.

Central bank digital currencies (CBDCs)

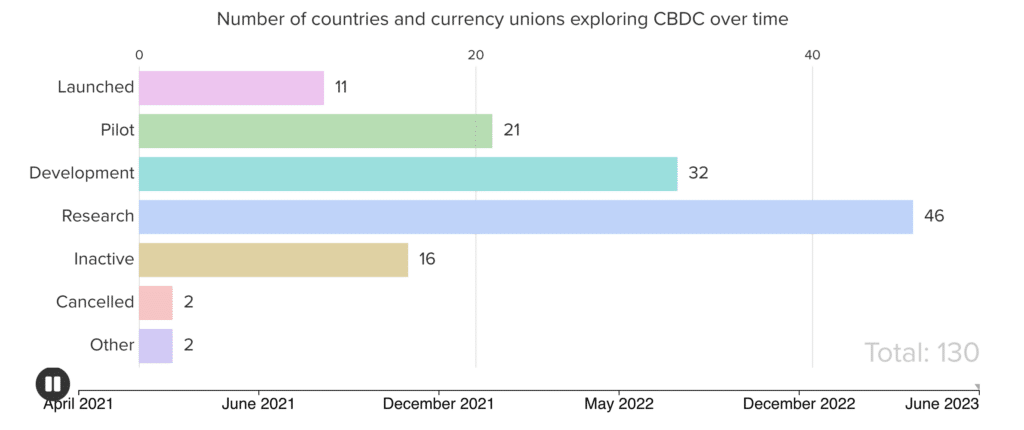

The push for CBDCs continues to gain momentum into 2024, with several leading central banks either exploring or already implementing CBDCs.

The Bank for International Settlements forecasts the introduction of up to 15 retail and nine wholesale CBDCs by 2030.

The successful rollout of CBDCs requires comprehensive infrastructure and frameworks, encouraging collaboration among institutions.

Cross-border payments

Financial institutions and banks are adopting crypto and blockchain technology for cross-border payment solutions, drawn by its capacity to facilitate more efficient and cost-effective transactions.

With leading companies and payment institutions leveraging blockchain to innovate and enhance their service offerings, financial giants and institutions could discover new use cases to improve their services.

FAQs

What is the institutional adoption of crypto?

Institutional adoption of crypto means big companies like investment firms and corporations are starting to use blockchain and digital assets in their financial plans. They’re seeing crypto as a valuable part of their investments, and they’re putting more money into it and planning to invest even more in the future.

Which crypto is most adopted?

Bitcoin is the most adopted cryptocurrency by institutions. This is highlighted by the approval of 11 spot Bitcoin ETFs by the U.S. SEC, which marks a crucial step towards integrating Bitcoin into mainstream financial products. The rapid accumulation of assets under management by these ETFs further underscores Bitcoin’s leading position in institutional adoption.

How are financial institutions using blockchain?

Financial institutions use blockchain to streamline and secure their operations, especially in cross-border payments. Blockchain offers faster, more efficient, and cheaper transaction processes compared to traditional methods. Examples include JPMorgan’s introduction of programmable payments for automated transactions and the Canton Network’s focus on tokenizing real-world assets, demonstrating blockchain’s broad applicability in modernizing financial services.