Major Institutions Lost $12 Billion After the Fed’s Rate Increase

The major institutional investors in BTC have lost more than $12 billion in the valuation of their assets, following the crypto market’s collapse after the Federal Reserve’s interest rate increase on May 4th.

Largest Institutional BTC Holders

According to the recent data by OKLink, the Top-5 companies with the largest BTC positions include Block.one, MTGOX K.K, Microstrategy Inc., Tesla, Inc., and the Tezos Foundation. At the same time, only the first three hold more than 100,000 BTC, implying that the concentration of BTC holdings is much lower as compared with the majority of other cryptocurrencies. Even the major institutional BTC holder Block.one controls only 0.86% of the total BTC supply. Nevertheless, these institutional investors suffered huge losses of more than $12 billion after the crypto market’s capitulation in recent days.

The initial reaction of market participants to the Federal Reserve’s interest rate announcement was positive as some analysts were concerned about the possibility of interest rates being increased by 75 instead of 50 basis points. However, the crypto community realized that the access to cheap credit resources was seriously restricted, and the Federal Reserve was still about to initiate further interest rate hikes in the following months. As a result, the pessimistic perception of the situation prevailed, thus leading to the dominance of bearish sentiments.

Strategies Implemented by Whales and Institutional Investors

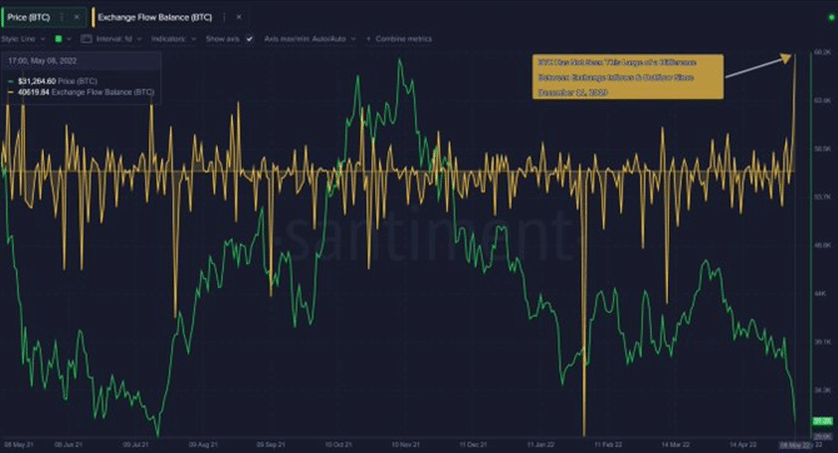

Despite the general panic observed in the market, most institutional investors and whales still perceive the present market conditions as the optimal opportunity to increase their holdings by implementing the “buy the dip” strategy. In contrast, most short-term investors and traders lack strategic thinking and prefer to sell their coins due to the concerns about the complete collapse in the following weeks. Such polarized opinions have resulted in the rapidly increasing activity observed in the major exchanges. According to the blockchain analytics company Santiment, the net inflow to exchanges being equal to 40,600 BTC constitutes the largest BTC movement in more than two years.

Despite the general panic observed in the market, most institutional investors and whales still perceive the present market conditions as the optimal opportunity to increase their holdings by implementing the “buy the dip” strategy. In contrast, most short-term investors and traders lack strategic thinking and prefer to sell their coins due to the concerns about the complete collapse in the following weeks. Such polarized opinions have resulted in the rapidly increasing activity observed in the major exchanges. According to the blockchain analytics company Santiment, the net inflow to exchanges being equal to 40,600 BTC constitutes the largest BTC movement in more than two years.

Moreover, such growing activity is characterized by the lack of consensus in the crypto community regarding the most likely BTC price in the following days and weeks. Bears may expect further price decline and may try to utilize such an opportunity for generating additional returns. Hodlers and institutional investors may use fundamental analysis that confirms that BTC is currently undervalued by the market, implying the reasonability of accumulating it regardless of short-term price fluctuations. Finally, some traders prefer to sell BTC, thus reducing their potential losses. However, the historical perspective illustrates that whales and institutional investors are more successful in identifying local bottoms and generating higher long-term returns.

BTC Price Projections

The current trends indicate that the crypto market may continue experiencing the growing regulatory pressure from the Federal Reserve for the following several months. At the same time, Bitcoin and the major altcoins will use this time for addressing the major technical challenges and consolidating before the next bullish cycle. In the context of Bitcoin’s short-term price dynamics, technical analysis can be used.

BTC has a strong support at the price of about $30,000 proven to be important for preventing the major cryptocurrency from uncontrolled fall. However, in order to reverse the negative trend, BTC has to overcome the following two major resistance levels: $35,000 and $40,000. The former represents the previous 6-months low, while the latter is the historically significant price. After exceeding these critical resistance levels, long-term investors can reliably enter the market and open long positions.