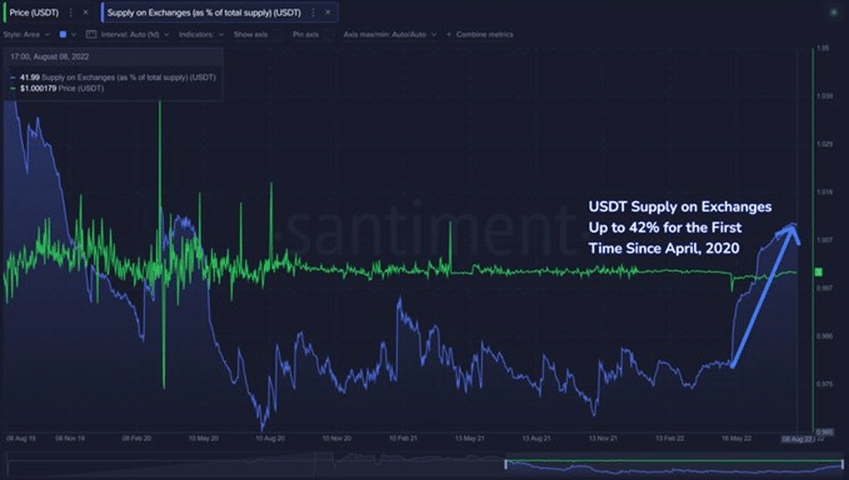

Ratio of USDT on Exchanges Has More Than Doubled in the Past 3 Months

The percentage of Tether on exchanges has more than doubled during the past few months, reaching the level of 42%, thus increasing the likelihood of serious price fluctuations in the following days.

USDT Ratio’s Dynamics

The dynamics of stablecoins’ supply may be critically significant for affecting the overall level of liquidity available in the crypto market. In most cases, significant changes in the distribution of stablecoins precede the radical changes in cryptocurrencies’ price levels. The recent days are characterized by the unprecedented increase in the percentage of the USDT supply moved to exchanges. This ratio was just 19.7% in the beginning of May but reached the very high level of 42% just in three months.

Figure 1. USDT Supply on Exchanges Dynamics; Data Source – Santiment

Such dynamics implies that traders are prepared to actively participate in trades, thus trying to maximize their profits or returns on investments. In case the majority of investors and traders make similar choices (for instance, closing long positions or opening short ones), the prices of the major cryptocurrencies may be significantly affected. The growing concerns regarding the CPI reports and other macroeconomic indicators may also explain such preparations made by traders. In any case, considerable price fluctuations may be expected in the following days.

Potential Scenarios

There is no major consensus among experts regarding the direction of cryptocurrencies’ price movements. In particular, traders may aim to take their profits obtained during the BTC and ETH appreciation over the past month. In this case, the selling pressure may increase, and bears can successfully utilize such a situation in order to test the major support levels. If the macroeconomic outlook remains mostly negative, the prices may decline to the new lows within the following weeks. The history of long “crypto winters” confirms the possibility of such a scenario.

An alternative explanation refers to reaching the local maximum in buying power. Thus, the 2-year maximum has been reached that may indicate bulls’ ability to accumulate the significant power that may be effectively used to facilitate significant price increases. This scenario would presuppose the complete trend reversal and the end of the “crypto winter”. All major bull runs were also associated with the high levels of stablecoins’ availability and their active use for purchasing those coins that demonstrate the highest market potential.

At the same time, the likelihood of the negative scenario (another stage of the crypto market collapse) is higher for the following reasons. First, the strong labor market makes it more likely that the Federal Reserve will increase its interest rates even higher. Second, the current consolidation appears to be similar to the previous ones that resulted in bears’ local victories. Third, the price dynamics during the past 24 hours illustrates the prevalence of negative sentiments in the majority of market participants.

Price Implications for the Major Cryptocurrencies

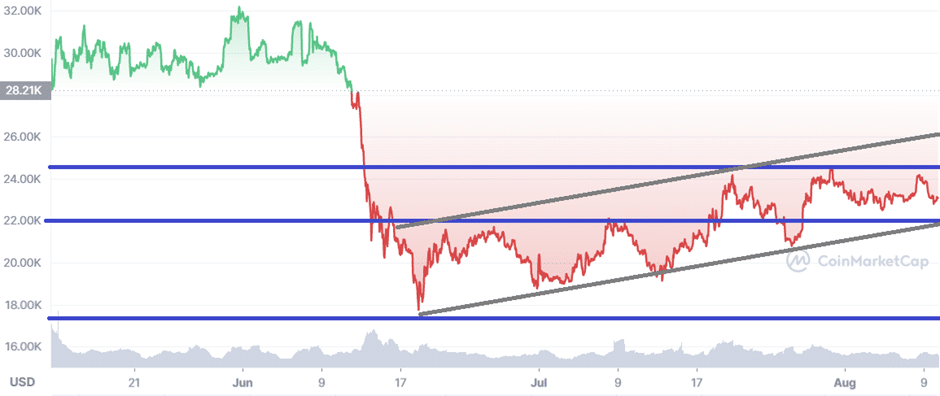

Technical analysis may be used in order to determine the major support and resistance levels that may affect the price and capitalization dynamics of the major cryptocurrencies in the short term. On this basis, traders can formulate the preferred strategy as well as determine the optimal points for market entry and profit-taking.

Figure 2. BTC/USD Price Dynamics; Data Source – CoinMarketCap

The major support level for BTC is at the price of $17,500 that corresponds to the local minimum of the past few months. An additional support level is at the price of $22,000 that may be tested in the following days. The key resistance level is at the price of $24,000 that prevents the further BTC price appreciation. In case the BTC price declines below $22,000, traders can reliably open short positions and target lower price levels.

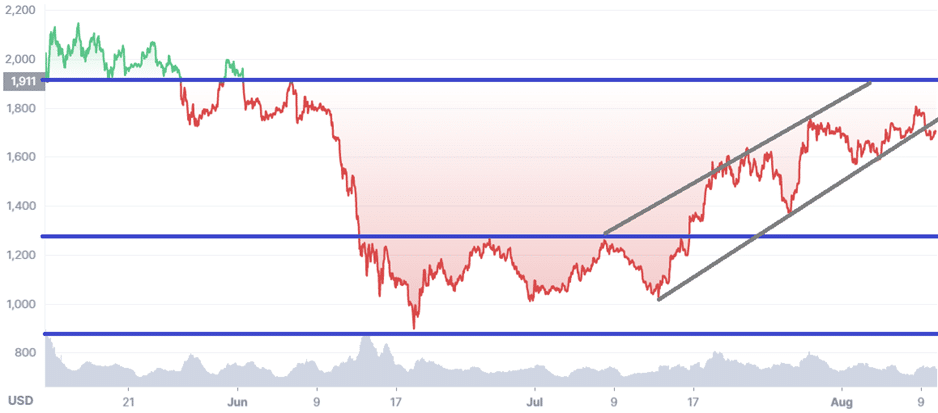

Figure 3. ETH/USD Price Dynamics; Data Source – CoinMarketCap

Ethereum’s price dynamics contains even more bearish elements. In particular, the upward price channel has been already broken. The first major target for bears is the support at the price of $1,300 that may contribute to the rapid correction to even the lower level at $900. Therefore, the proper risk management should necessarily be exercised in this regard. The correlation between the BTC and ETH prices may remain high.