Web3 needs to regress before we can progress in 2024 | Opinion

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

On the surface, things now seem very different from a year ago, with Bitcoin (BTC) being more than double the $16,000-17,000 and the total market cap of crypto being comfortably above a trillion dollars.

While the prices do indeed reflect some form of recovery partly fuelled by speculation around the approval of Bitcoin ETFs, we haven’t progressed enough as an industry, as most of the barriers to crypto adoption still remain unresolved.

It may have been a grueling crypto winter, and the resurgence of bull-posting on X (former Twitter) is a welcome contrast, but the industry needs to “regress and slow down” to make meaningful progress in 2024. Otherwise, it will basically be going through a repeat of the previous market cycle, albeit with a few improvements or differences.

The industry is still nascent and only slightly over a decade old, and there are still solid use cases lacking as a result—but this youth will not last forever, and neither should the status quo.

Cementing the backbone for crypto adoption: we need to slow down

The fast-paced nature of the industry can be exhilarating and impressive at times, as a lot can change in the span of a day or week, like most technology-based industries. However, this can be a double-edged sword as it inclines us to focus on the new rather than the old and be stuck in an echo chamber of sorts.

While it may be counterintuitive, the industry needs to force itself to slow down instead of always looking to go faster. It also needs to look at what has been done outside of web3 that has already been tried, tested, and, more importantly, resilient and prosperous.

Sure, Metaverse-focused utilities such as NFTs, web3 gaming, and SocialFi may be refreshing ideas. Still, they are much too foreign to mainstream users to be effective pull factors for mainstream adoption. Such utilities serve as excellent, unique niches for the industry, generating curiosity and interest—but should not be misconstrued as drivers for mainstream adoption, at least not for the near future.

The reality is that blockchain technology is already complex enough as it is to understand for new users, and this hasn’t changed much. Adding relatively foreign ideas to the mix as a focal point only exacerbates this further.

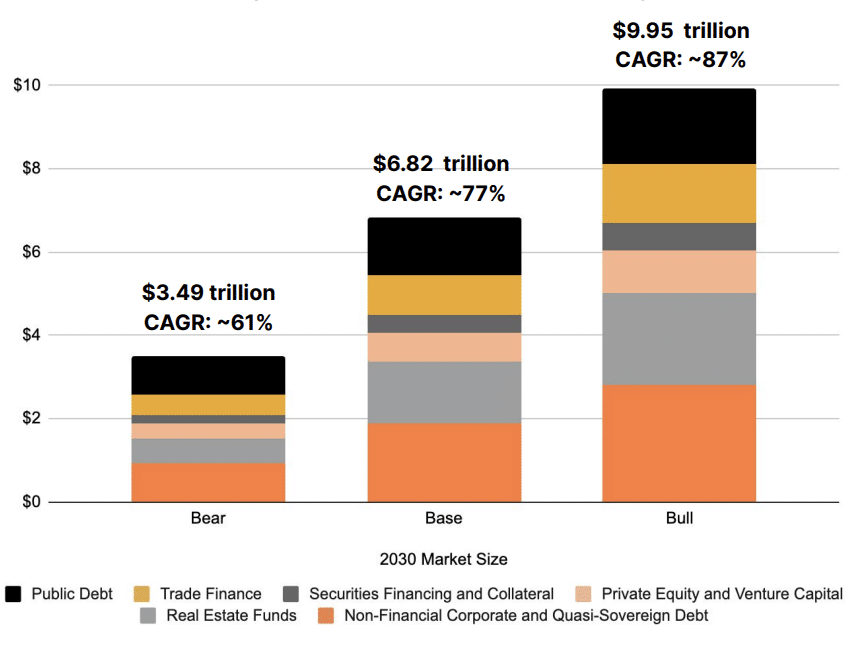

This is where battle-tested and more tangible utilities such as established payment systems and real-world assets (RWAs) come in as a more viable foundation for adoption—most mainstream users already understand how most of these function, and the grounded nature of these utilities are much more appealing and suitable for institutional and mass adoption as compared to newer and riskier verticals. Unsurprisingly, the data and metrics also back this up; the total value locked (TVL) for RWAs is currently sitting at $5.7 billion in TVL, with projections for growth up to $10 trillion.

Estimated tokenization market sizing | Source: 21.co

As for payment systems, we are also seeing established legacy players such as Visa and Mastercard making moves to support crypto usage in 2023, and this trend will only continue to gain momentum in the coming year.

Accessibility has always been a problem hindering adoption for web3 and crypto, so having more convenient on and off-ramps for crypto will undoubtedly be necessary for user acquisition and retention. Coupled with regulatory compliance, these utilities will be the real backbone and foundation for adoption as they are stable and reliable enough to withstand the test of time.

Sustainable business models over Ponzi schemes and promises

While speculation undeniably fuels the web3 space, this creates a level of volatility and instability that intimidates and deters new entrants—the web3 industry cannot rely on this if it is to scale beyond being treated simply as a decentralized casino.

Features such as memecoin trading also do not add much legitimacy to the industry for mainstream users to take web3 seriously, and this all needs to change.

As the industry matures, tokenomics, trendy narratives, and buzzwords will take a backseat to sustainable business models in 2024, as projects without actual value creation and revenue generation continue to be weeded out by increasingly discerning users. We’ve already gotten important lessons from FTX, Luna, USTC, and most recently SafeMoon on the importance of decentralization, self-custody, and proper due diligence.

The crypto space does tend to have goldfish memory, and most users are happy as long as they are making money and forget about existing concerns—but this approach needs to change as ponzinomic projects do not bring any meaningful positives to the industry and do not last forever.

Frauds like FTX may have grown to a colossal size and lasted for a long time on empty promises and lies, but eventually collapsed and damaged the industry’s credibility tremendously.

Conversely, projects like Pudgy Penguins and their move to introduce a real-world toy collection, in addition to typical NFT utilities, have done relatively well through the bear market, unlike most NFT projects. This isn’t a mere coincidence and highlights the importance of having sustainable business models.

In 2024, we will see more and more positive examples as projects deliver on their product roadmap and drive actual utility triumph over competitors with empty promises and hype-based marketing. Both builders and users need to be practical and patient instead of hunting for moonshots or simply looking to make a quick buck to build and support projects with proper revenue sources.

Web2.5 taking center stage as a driver of web3

Aside from projects requiring sustainable business models, another core issue is that web3 infrastructure cannot currently maximize the industry’s full potential due to its nascency. As an example, decentralized exchanges (DEXes) provide an essential foundation for decentralized finance, which is a core vertical of web3—but trading volume and liquidity for the top DEXes are still bested by the leading centralized exchanges due to the familiarity of the user experience, better slippage, depth of liquidity, and more.

While decentralization maximalists might not like the notion, many mainstream users are much too comfortable with custodial services to jump straight into self-custody—resulting in many centralized services acting as a bridge of sorts into web3.

We already see such a trend slowly growing, with Coinbase providing a gateway for its users into the Ethereum ecosystem with its L2 Base, Binance providing its users with an entry point into defi with its recently launched web3 wallet, and even Telegram-focused custodial wallet TON Space.

More and more of such web2.5 products and services, which are built on a hybrid mix of the decentralization from web3 and battle-tested efficiency from web2, will drive critical use cases and larger-scale adoption for the crypto industry.

The security aspect of the infrastructure also needs to be improved, as the web3 industry is still rife with scams and exploits—with $290 million being lost from just five hacks in November alone and legacy wallet providers like Ledger falling victim to an exploit which put many users at risk in December.

It is still far too early for decentralization alone to be the means to an end, as the web3 industry still requires more time to mature. User education also has a pivotal role, along with product UI and UX improvements. As it stands, decentralization and its autonomy should be an end state that the web3 industry strives to make accessible, safe, and easy to use even for mainstream users.

While this has not yet been achieved, the “progression through regression” for web3 in 2024 should be celebrated, as it will undoubtedly bring the industry closer to making significant breakthroughs and mainstream adoption possible.