XRP is not a security, US judge rules

Ripple Labs has emerged victorious in its long-standing legal battle with the U.S. Securities and Exchange Commission (SEC).

On July 13, Federal District judge Analisa Torres ruled that XRP, the native currency of the XRP Ledger (XRP), is not an unregistered security, except when used to raise funds from institutions.

Ripple Labs has been at odds with the SEC since December 2020, when the commission alleged that Ripple, the blockchain company, and its co-founders—CEO Bradley Garlinghouse and executive chairman Christian Larsen—raised $1.3 billion in an illegal offering using XRP.

Judge Torres concluded that $728 million worth of Ripple’s institutional sales did indeed constitute such sales. However, she ruled that programmatic sales to the public and XRP distributions to Ripple Labs employees were not unregistered securities sales.

Judge Torres evaluated the case using the three-pronged Howey test.

The court agreed there was an “investment of money” and a “common enterprise” but found the third prong — “a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others”— could not be established for public sales.

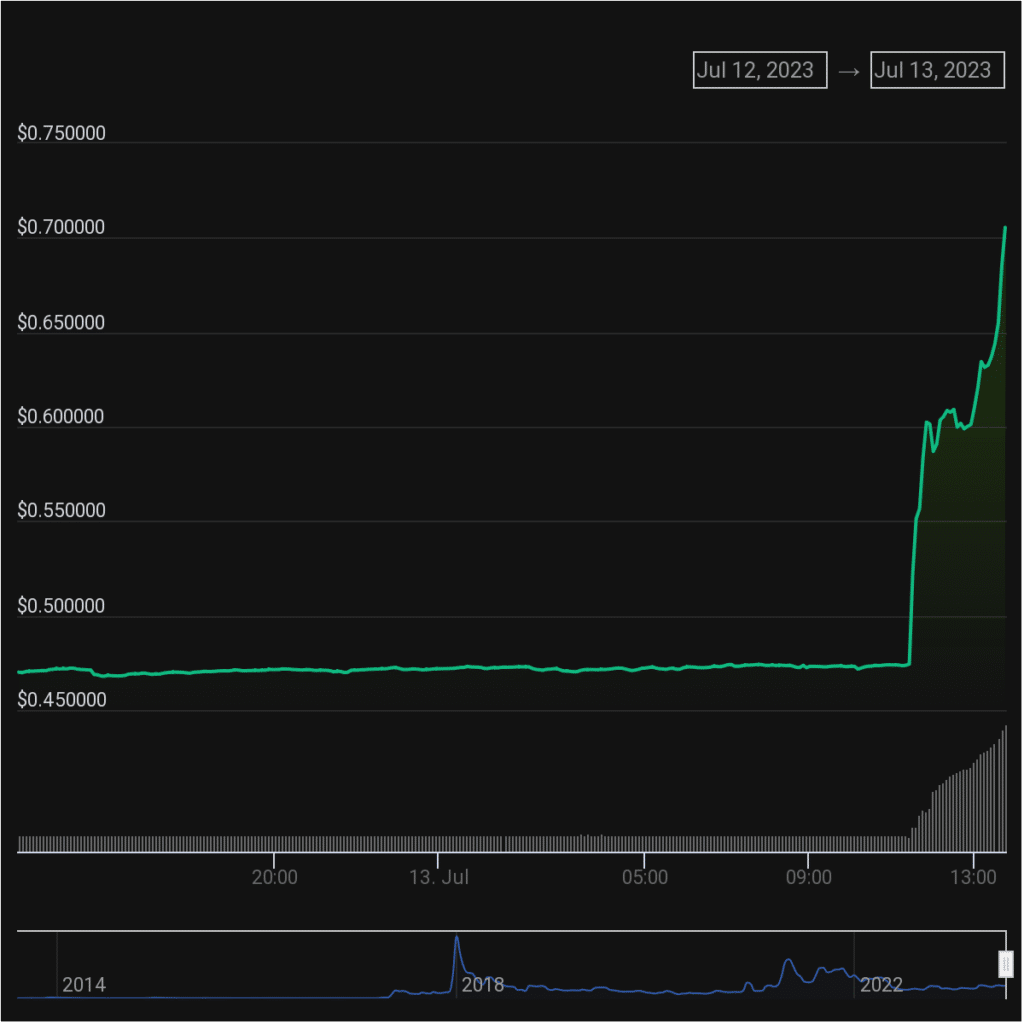

This nuanced verdict led to a surge in XRP’s price by 52% within two hours, reaching a high of 71.6 cents—its peak since April 2022—according to data from CoinGecko.

The ruling has also opened up a potential new framework for the classification of tokens in future cases.

A crucial factor in the legal process was the “Hinman documents” – internal SEC drafts and emails linked to a 2018 speech by William Hinman, the then-director of the SEC’s Division of Corporation Finance.

In his speech, Hinman suggested that tokens could initially start as securities but evolve over time.

Ripple’s defense used these documents to argue for the inconsistency of the SEC’s stance towards different projects. However, the direct impact of these documents on the Ripple judgment remains unclear.

The lawsuit and its subsequent ruling come when the SEC is increasingly scrutinizing the crypto industry, with actions against firms such as Kraken, Nexo, and BlockFi.

The Ripple case could potentially shift the dynamics of future enforcement actions, but the implications remain to be seen.