NFT market analysis: 2023 highlights and 2024 forecast

As the year draws to a close, we do an NFT market analysis, mapping its trajectory and comparing it with the predictions experts have laid out for 2024.

2023 was not the best year to be a non-fungible token (NFT) holder or trader. Following nearly two years of unprecedented growth, a liquidity plunge hit the NFT market in Q4 2022, persisting into mid-2023.

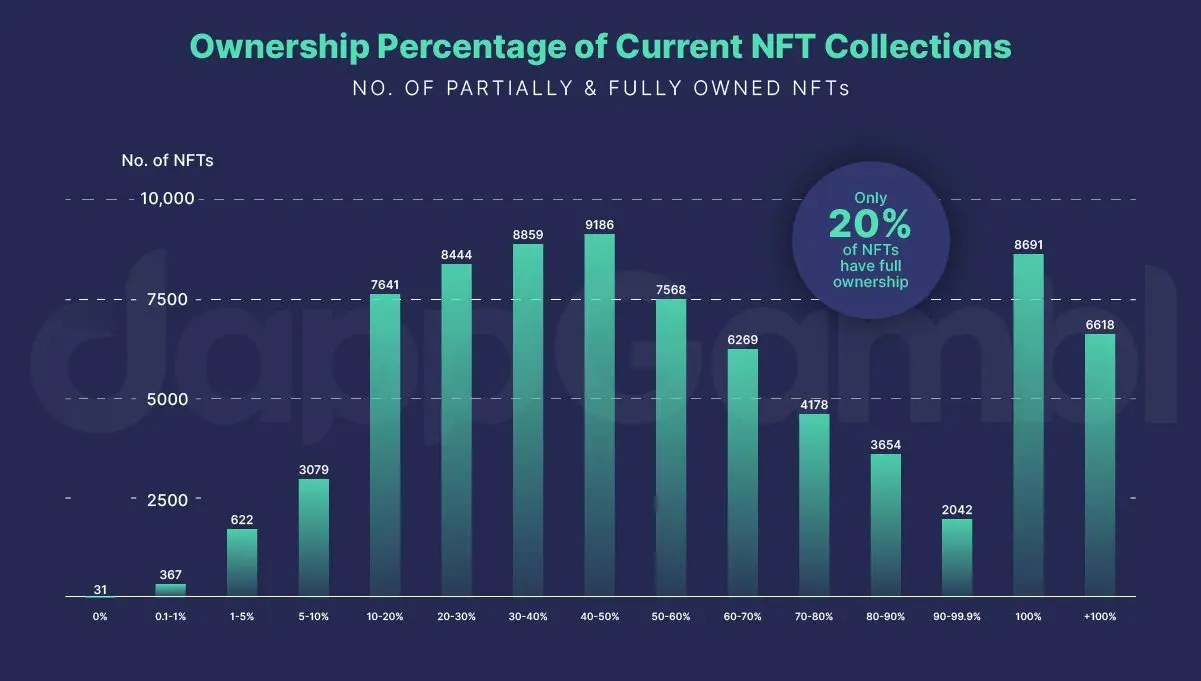

It caused the floor prices of at least 95% of NFT projects to crash near zero levels, as revealed by a dappGambl report from September.

To stress the gravity of the situation, the report indicated that nearly 80% of all NFT tokens remained unsold as there was virtually no demand to keep up with the supply.

Furthermore, per dappGambl, less than 1% of nearly 9,000 top NFT collections it surveyed had a value north of $6,000. About 41% were priced between $5 and $100, while 18% were worthless, with a floor price of 0 Ether (ETH).

NFT market analysis for 2023

Despite the decline in the broader crypto market, NFT trading volumes increased sharply in Q1 2023. The improved numbers came from zero-fee incentives, airdrops from the Blur NFT marketplace, and its royalty wars with OpenSea.

During that early part of the year, NFT token transactions reached $4.7 billion, with Ethereum dominating the market, registering $514 million in trades in one month alone.

The network also accounted for at least 50% of total NFT transactions in 2023, with average monthly transaction volumes of between 1 and 2 million per data from CryptoSlam.

Meanwhile, Solana (SOL) experienced a dip in its NFT market size as it struggled with the fallout from the FTX bankruptcy and a series of downtimes and glitches that affected it in 2022.

However, after attaining a high of 74,550 ETH in mid-February, trading volumes across NFT blockchains decreased gradually, with NFT coin holders reaching year-low levels by April, per data from NFTGo.

Q1 2023 also saw the resurgence of the NFT lending market. Players in the space disbursed more than $25 million in the first three months of the year, with platforms like ParaSpace becoming the most prominent, while NFTFi accrued the highest number of NFT lending users.

One of the main talking points of the 2023 NFT landscape was Bitcoin’s (BTC) unique take on non-fungible tokens. The so-called Bitcoin Ordinals offered a different spin from the more popular variants on networks like Ethereum and Solana. However, they came with limitations, including slower transaction speeds and a limited application range.

But despite these challenges, Bitcoin’s NFT ecosystem made significant strides, exemplified by Yuga Labs’ successful auction of its TwelveFold collection.

Launched in February 2023, Bitcoin Ordinals generated about $400 million in trading volumes by May, with total sales just north of 832,000.

Elsewhere, Gem.xyz’s rebrand to OpenSea Pro also made headlines. It was accompanied by introducing the Gemesis NFT line, which registered rapid trading growth and a steady holding time and value among users.

November stood out as a month of recovery following a period of lean profitability. According to CoinDCX, more than 40% of traders turned a profit that month, a trend reminiscent of the market stability observed in the second quarter of 2022.

Market watchers also noted an increase in unique active wallets and trading volumes. Some sources pegged the trading volume escalation at 125%, which observers considered a manifestation of collective investor confidence and echoed the positive outlook prevalent in the broader crypto market in November.

Concurrently, the holding period for NFTs saw a steep decline, from an average of 100 days in October to just 18 days in November. Analysts saw this as indicating a shift in strategy towards short-term holding, which may have reflected readiness among NFT traders to exploit shorter market cycles.

However, the positive outlook did not stop average NFT prices from dipping by about 42% in Q4 2023 to settle around the $150 mark.

NFT market research

NFT market research by TechNavio revealed that the collectible token sector is poised to grow off the back of rising global demand and the digital transformation of various industries.

According to the firm, increasing internet and mobile usage has prompted companies to extend their digital asset offerings and investments.

On a regional scale, the survey projected the Asia-Pacific region to contribute as much as 39% of the global NFT market cap. This is underpinned by increased demand for non-fungible tokens in countries like Singapore, South Korea, the Philippines, Japan, and China.

Furthermore, the research revealed that the NFT market size is bolstered by expansion into art and fashion sales in retail outlets, exemplified by partnerships like CJ OliveNetworks and Galaxia Metaverse.

Another market survey carried out by NFT data provider NFTGo determined that the mean assets per investor for individual NFT projects were $3,893, while the median value stood at $1,459.

The marked discrepancy between the two figures, with the average exceeding the median by 63%, suggested that assets held by wealthier investors significantly inflated the mean per capita assets, further widening the wealth gap among participants in different projects.

A closer look at NFTGo’s data revealed that although the year was marked by selling, significant purchases were also observed, especially for top-tier NFTs like CryptoPunks, which traded at an average price of 67.05 ETH.

NFT market value in 2023

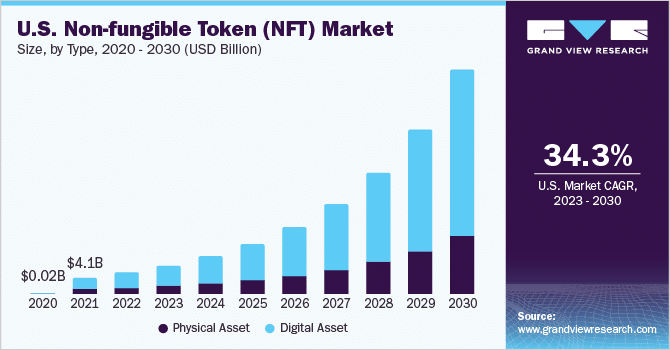

Expert predictions had the U.S. NFT market, valued at about $22 billion at once, growing at a compound annual growth rate (CAGR) of more than 34% between 2023 and 2030.

However, as previously stated, the NFT marketplace growth in 2023 saw a significant decline, with transaction volumes slumping to $4.7 billion, starkly contrasting the $12.6 billion volume recorded in the same period in 2022.

With the public losing interest in NFTs, leading marketplaces such as OpenSea witnessed significant drops in deal values between December 2021 and December 2022, and this trend was mirrored across several other platforms as well.

OpenSea’s monthly active user base stood at around 250,000, with the platform observing a remarkable 450% surge in unique NFT buyers between 2020 and 2021. This spike saw the monthly buyer volume soar from 10,000 to 40,000.

However, Q1 2023 marked a low number of NFT holders, possibly traced back to the royalty wrangling between Blur and OpenSea.

Interestingly, up until 2022, there were more buyers than sellers in the NFT market, with a ratio of 1.3 to 1. By 2023, however, there was a shift in the market graph, with sellers outnumbering buyers, signaling a potential change in market behavior and possibly marking the beginning of the NFT market’s second major cycle.

NFT trend analysis

The emergence of several trends marked the 2023 NFT market. Top among them was the reshuffling of major blue-chip NFT projects. Despite initially being profitable, many of these projects started steadily declining due to the bear market that gripped the broader crypto sector in late 2022 and early 2023.

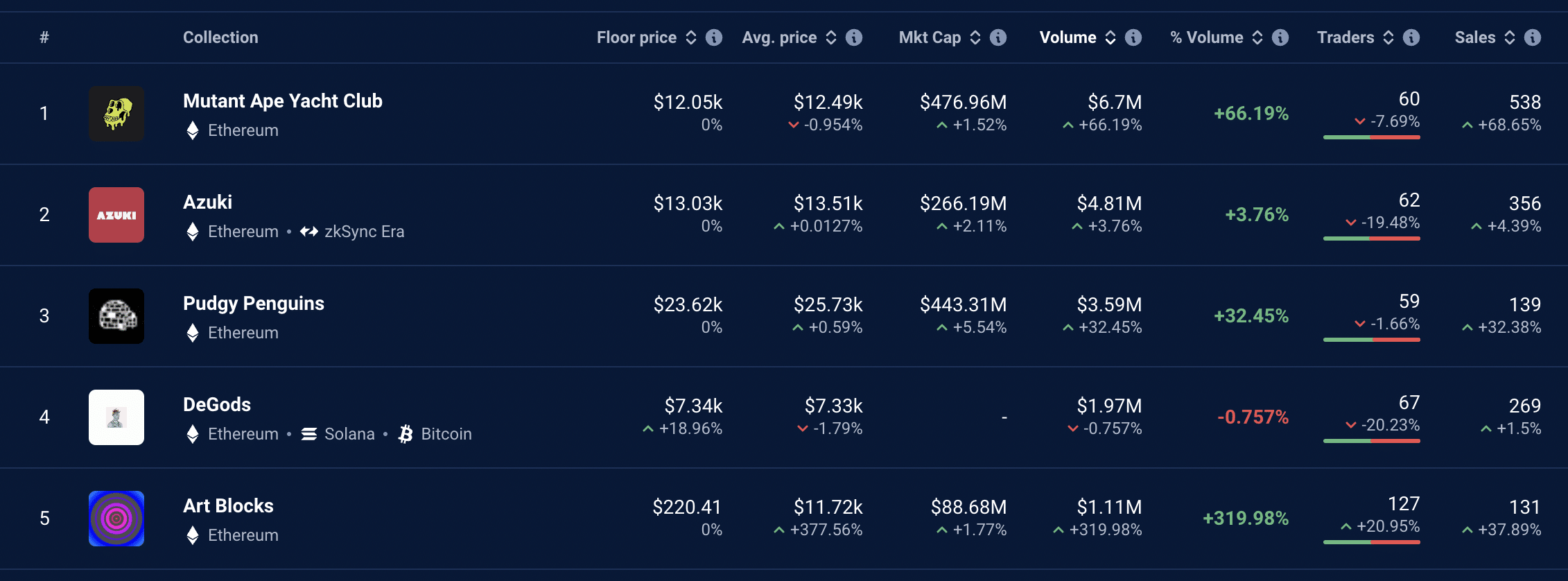

Leading projects such as Bored Ape Yacht Club (BAYC) stood firm against the prevailing bear wave, while others like Azuki struggled initially but later bounced back. In contrast, smaller projects such as Moonbirds took a hit on their profitability immediately after launch and have yet to recover.

2023 also saw what analysts considered a significant evolution in the behavior and profitability of NFT traders. They observed a shift in NFT ownership, with prominent investors increasingly dominating the market. For instance, according to NFTGo, projects like Azuki saw the number of whale owners double.

The next highest whale owner increase was observed in Moonbirds, whose general ownership dropped by 1%, but the number of whales increased by 41%.

Doodles and CLONE X each registered 24% increases in the number of large investors, while CryptoPunks stood at 22%. Among the top NFT projects, BAYC reported the lowest increase in whales at 18%.

Due to their substantial holdings and influence, many felt whales were pivotal in steering NFT market trends in 2023.

Another trend noted in 2023 was the need for more sustainable demand for new NFTs. While projects such as HV-MTL, Otherdeed Expanded, and Otherside Vessel performed steadily, others, like Nakamigos and Checks-VV, needed to sustain early strong momentums.

Another interesting tidbit gleaned from statistics collected by DappRadar was how blockchain games remained the top NFT category, with trading volumes led by Axie Infinity. The game’s NFT collection was the most traded, hitting a market cap of $224 million at one point. Other popular web3 games included NBA Top Shot, Mythical Beings, Gods Unchained, and NFL All Day.

However, at the same time, the market saw floor prices for top NFTs and metaverse land falling significantly. At one point, BAYC floor prices were as low as 24.8 ETH, a stark drop from their 152 ETH peak in Q2 2022.

In December, the NFT market recovered slightly, with Mutant Ape Yacht Club leading the list.

Finally, experts have attributed the NFT market’s growing visibility to the increasing interest of mainstream brands, including Visa and Budweiser. Such firms have strategically acquired existing NFTs instead of generating their own.

The appeal of NFTs to these big brands stems from the potential for additional revenue streams. Moreover, the adoption of NFTs as customer rewards is becoming increasingly prevalent, with such dynamics expected to generate a positive effect across the NFT market and propel its growth trajectory in the new year.

NFT market forecast for 2024

Despite the troubles encountered by NFTs in 2023, many analysts remain bullish about the technology’s prospects heading into 2024.

Here are some key developments they expect to happen that may change the trajectory of NFTs:

NFTs evolving beyond collectibles

Going into 2024, many anticipate a shift in the NFT landscape as it moves from collectibles to utility-driven digital assets. Tokens with real-world applications could mark a crucial change in the NFT paradigm, with such tokens serving as conduits between the digital and physical worlds, offering value beyond artistic appreciation.

GameFi

Analysts also expect the integration of NFTs will change gamification, enabling actual ownership of in-game assets and incentivizing players with rewards for engagement.

Regulatory clarity

The enhancement of crypto regulatory frameworks in the coming year is expected to coincide with the maturation of the NFT crypto market.

Regulators worldwide are developing guidelines to ensure a more secure and transparent environment to build trust and market stability. This could offer a safe environment for NFT creators, traders, and investors to pursue their respective activities.

Integration with defi

There have also been suggestions that NFTs could merge with decentralized finance protocols in 2024, a step many consider revolutionary as it would allow for tokenizing real-world assets as NFTs and connecting traditional finance with crypto.

It could give NFT crypto holders the option to leverage their tokens as collateral for loans or to generate interest via defi platforms, thus representing a considerable leap towards financial inclusivity and asset monetization.

Cross-platform interoperability

Proponents are also banking on improved interoperability between networks such as Cosmos and Polkadot (DOT) to transform the NFT market.

Enabling users to move non-fungible tokens across different blockchains smoothly could expand opportunities for creators and collectors and further reinforce the integration of the digital asset ecosystem.

AI-powered NFTs

Hope is rife in the NFT space that artificial intelligence will personalize the NFT crypto experience, offering tailored engagement, unique creations, and new use cases for the tokens in 2024.

Growth projections

TechNavio’s analysis anticipated the NFT market size to expand at a CAGR of 30.28 between 2024 and 2028 and eventually hit at least $68 billion. The firm’s researchers pegged their optimism on several key drivers, such as escalating interest in digital art and growing use cases for NFTs, including those listed above.

In 2024, TechNavio’s prediction outlined a year-over-year growth in the NFT market cap of at least 23.27%.

Regarding geographical regions, North America and Europe have been at the forefront of NFT adoption. However, statistics collated by Metav.rs looking at NFT consumer behavior showed that Singaporeans, Chinese, and Venezuelans were the most active NFT traders in 2023. Nigeria showed promising potential for future growth, possibly ranging from 13.7% to 35.3%.

Additionally, the Metav.rs figures revealed women in Thailand showed a higher interest in NFTs, with 30% collecting them compared to 23% of men. Notably, 70% of Americans were unaware of what NFTs are, while in France, 3.5% of the population have purchased NFTs, and almost half of the French youth aged 18-24 are open to buying NFTs.

These potential areas of growth come with caveats, regulation being one of them. As governments worldwide take a keener interest in the crypto space, industry watchers expect to see more rules and regulations that could impact NFT markets as well.

FAQs

How big is the NFT market?

The global non-fungible token market size was valued at $20.44 billion in 2022.

How much is the NFT market worth?

The NFT market is expected to grow at a compound annual growth rate (CAGR) of 34.2% from 2023 to 2030.

Is the NFT market growing?

Yes, the NFT market is growing, driven by the distinctiveness, transparency, and security of NFTs, as well as the increasing interest in digital ownership.

What are the key factors driving the growth of the NFTs market?

The growth of the NFT market can be attributed to the rise of social media and digital platforms, the adoption of blockchain technology, and the convergence of traditional industries with the NFT market.