SEC might cite market manipulation to deny further Bitcoin ETFs

The U.S. Securities and Exchange Commission (SEC) may have found additional ammunition to deny future Bitcoin ETF applications following a recent misinformation debacle.

The latest development involved false reports claiming the SEC’s approval of a Bitcoin ETF from BlackRock, which led to significant market volatility.

Fake news on Bitcoin ETF

On Oct. 16, cryptocurrency media outlet Cointelegraph erroneously reported that the SEC had approved a spot Bitcoin ETF from BlackRock’s iShares.

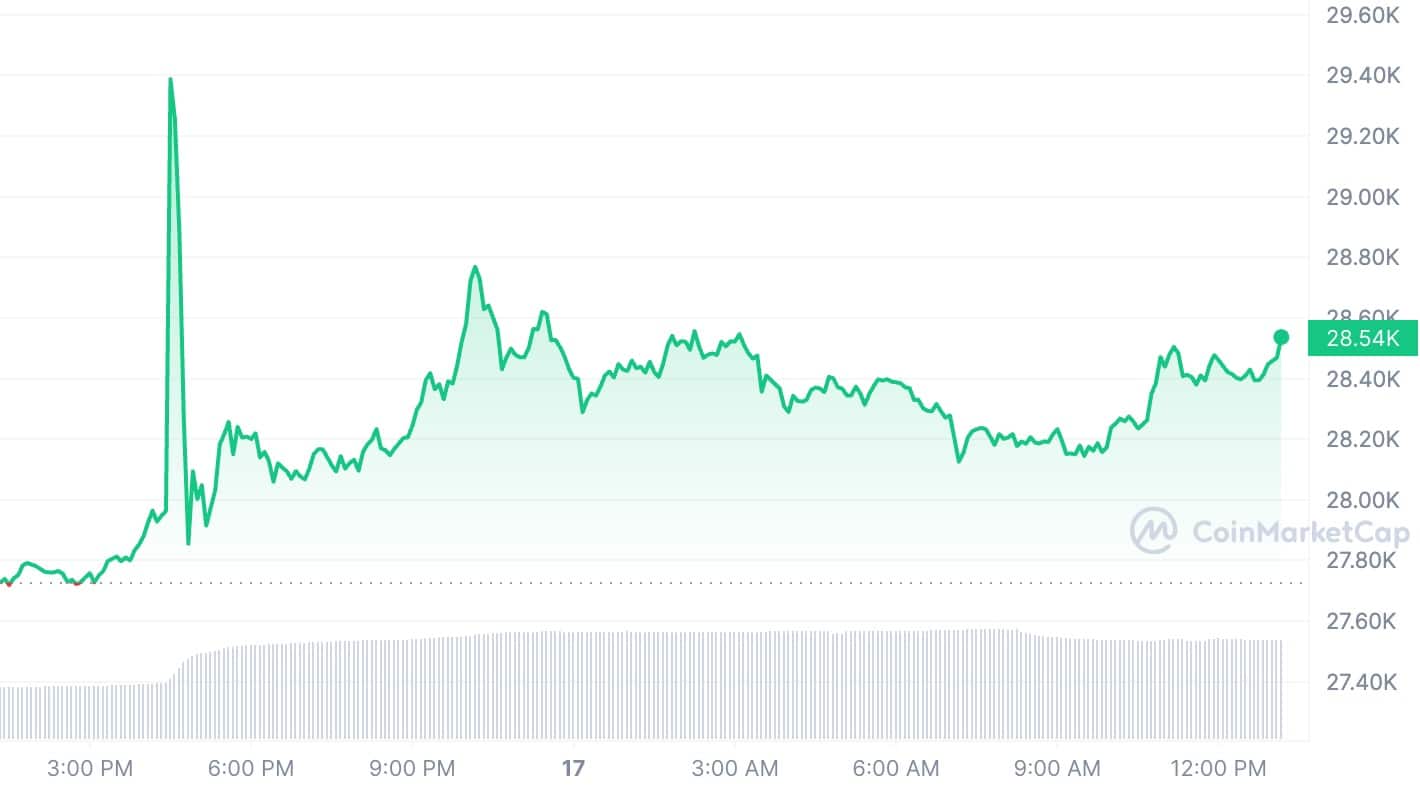

The false news was widely circulated on social media, causing Bitcoin’s (BTC) price surge.

BlackRock quickly clarified that its ETF application was still under review, but the damage was already done. The incident led to market liquidations worth approximately $182.5 million in the last 24 hours.

Cointelegraph subsequently amended its original article, adding the qualifier “reportedly” to its claims. This editorial change sparked criticism and humorous reactions from the public, who questioned the outlet’s journalistic standards and decision-making in sharing such impactful news.

Even after apologizing and providing a detailed account of the mistake, the outlet couldn’t quell the community’s lingering dissatisfaction and ire.

SEC’s warning and market consequences

The SEC responded by issuing a stern warning on social media, stating, “Careful what you read on the internet. The best source of information about the SEC is the SEC.”

The latest wave of misinformation triggered a volatile swing in Bitcoin’s price, initially elevating it from nearly $28,500 to a brief peak above $30,000 before it descended to levels close to $28,000.

Possible impact on Bitcoin ETF approvals

Observers have noted that such episodes of misinformation could provide the SEC with justifiable grounds to deny future Bitcoin ETF applications.

The agency could argue that the cryptocurrency market is too susceptible to manipulation, as evidenced by the recent fake news incident.

This aligns with comments from market analysts like Bitfinexed, who tweeted that the SEC now has a case for market manipulation that could be cited in future Bitcoin ETF denials.

Despite the setback, experts in the field maintain a positive outlook. Bloomberg analysts, for example, project a 90% chance of a spot Bitcoin ETF approval by early 2024.

In an interview with Fox Business, BlackRock CEO Larry Fink expressed that the incident reflects the growing interest and demand for cryptocurrency investments.

Fink highlighted that his discussions with their worldwide clients show a growing eagerness to invest in cryptocurrencies.

Looking ahead, he envisions cryptocurrency becoming a crucial asset for investors, especially as a financial refuge in unstable economic conditions.