SEC vs crypto: regulatory battles and trends in 2023

Explore the dynamic landscape of SEC vs. crypto in 2023. Discover the hurdles in regulations and changing trends influencing the crypto world’s future.

Over the past few months, the U.S. Securities and Exchange Commission (SEC) has frequently appeared in the news and crypto media. Most news stories revolve around SEC lawsuits against crypto projects or noteworthy statements by Gary Gensler. However, this wasn’t always the case.

From 2018 to 2021, the SEC primarily focused on major ICOs like TON or KIK, with the regulator’s attention being more of an exception than the norm in the free U.S. crypto market. The change began in April 2021 when Gary Gensler replaced the crypto-friendly Chairman of the Commission, Jay Clayton. Gensler’s arrival marked the start of a new crypto doctrine at the SEC, later termed a “crusade against the crypto market” by Coinbase’s head.

The first alarm sounded in Gensler’s September 2021 statement advocating crypto market regulation. Initially, it appeared as a friendly offer to companies facing regulatory uncertainty. However, since the start of 2022, the SEC has consistently made concerning declarations regarding cryptocurrencies, intensifying the SEC vs. crypto narrative:

- The SEC claims authority to regulate defi platforms, even if they’re decentralized.

- All PoS tokens have characteristics of securities.

- Determining blockchain jurisdiction should be based on validator locations

- Cryptocurrency projects are a primary focus for SEC inspections.

The situation intensified following the FTX collapse, exposing flaws in existing rules and inadequate investor protection. By 2023, statements became more radical:

- There is no need for special legislation to regulate cryptocurrencies.

- All cryptocurrencies except Bitcoin (BTC) are securities.

- Crypto markets do not meet regulatory requirements.

- The SEC plans to focus on the defi sector.

- The U.S. needs only a few digital assets.

While there were friendlier opinions toward cryptocurrencies, like opposing the Howey test’s application to cryptocurrencies, the overall direction of policy and the SEC’s stance were largely seen as unfriendly towards the crypto industry.

SEC vs. Ripple

The U.S. regulator filed a lawsuit against Ripple in December 2020, alleging the company of illegal trading of securities – XRP tokens.

Nearly three years later, in July of this year, Judge Analisa Torres of the Southern District of New York ruled in favor of the crypto project. She declared that XRP cannot be categorized as a security. However, the judge noted that institutional sales of tokens might still be considered as transactions involving unregistered securities.

Towards the end of October, the regulator opted out of further involvement in the Ripple case trial, leading to the dismissal of all charges against the site’s management.

SEC vs. Bittrex

On Apr. 17, 2023, The SEC filed a complaint against the Bittrex cryptocurrency platform in the U.S. District Court for the Western District of Washington. The regulator alleged that Bittrex functioned as an unregistered broker, exchange, and clearing agency, offering services to U.S. investors related to crypto assets, which might be classified as securities.

Moreover, as per the Commission’s assertions, Bittrex, along with William Shihara, the company’s CEO from 2014 to 2019, purportedly advised issuers aiming to list their assets on the platform to eliminate potentially problematic statements from social media and other public channels.

As part of the settlement, which is subject to court approval, the defendants have agreed to the entry of final judgments that permanently enjoin Bittrex and Shihara from violating Sections 5, 15(a), and 17A of the Securities Exchange Act of 1934, and also prohibit Bittrex Global from violating Section 5 of the same law.

In addition, Bittrex and Bittrex Global agreed to pay, on a joint and several basis, compensatory damages of $14.4 million, a fine of $4 million, and a civil penalty of $5.6 million, for a total of $24 million.

SEC vs. Genesis & Gemini

In January, the SEC initiated a lawsuit in the U.S. District Court for the Southern District of New York against crypto broker Genesis Global Capital and the Gemini exchange, alleging violations of the Securities Act. According to a report on the regulator’s website, the court documents claimed that the crypto exchange and lender Genesis offered and sold unregistered securities through the Gemini Earn program.

Investors on the Gemini platform were offered the opportunity to earn up to 8% annually through this product. The SEC noted that investors loaned their crypto assets to Genesis as part of the program, with Gemini acting as an intermediary and charging a commission—sometimes as high as 4.29%—from clients’ earnings.

In September, Genesis announced a complete cessation of trading services, including GGC International, citing voluntary and business-related reasons. However, the company reassured clients with active derivatives positions that those positions would be exercised before their expiration. The discontinuation of trading services became effective on Sep. 21.

SEC vs. Binance

In early June, the SEC sued the crypto exchange and CEO Changpeng Zhao, alleging multiple violations of U.S. laws. These violations encompassed access to American clients’ funds by the parent company (Binance Ltd), commingling of funds, breaching securities laws (identifying several cryptocurrencies as such), and misleading investors.

On Sep. 15, the SEC accused the crypto exchange and CEO Changpeng Zhao of concealing information and obstructing the investigation. The regulator requested the court to perform a judicial review, subpoena crucial witnesses, and issue a judicial mandate to furnish all requested documents.

Binance chose to prolong the legal proceedings by withholding the requested documents, citing the SEC’s crypto requirements as ‘excessively burdensome.’

However, Binance had to find common ground with American regulators. In November, the leading crypto exchange agreed to a settlement involving Zhao, who admitted guilt in a U.S. money laundering case. To resolve the dispute, Zhao announced his resignation and volunteered to pay a personal $50 million fine. Additionally, as part of the lawsuit, the company admitted fault and agreed to a $4.3 billion fine.

SEC vs. Coinbase

Following Binance, another crypto exchange, Coinbase, came under the SEC’s radar. On Jun. 6, the regulator accused the platform of operating as an unregistered broker. This is the second major cryptocurrency company to receive a lawsuit from the SEC.

According to the SEC, since at least 2019, Coinbase has made “billions of dollars” from illegally conducting purchases and sales of cryptocurrency assets. At the same time, the Commission argues that Coinbase’s failure to register deprived investors of essential protections, including SEC inspections, record-keeping requirements, and protections against Commission of interest.

However, the regulator’s lawsuit did not prevent the further development of Coinbase. In November, the company’s shares reached their highest value since May 2022, shortly after SEC’s crypto news that Binance and its former CEO Changpeng Zhao pleaded guilty to violating U.S. laws.

SEC vs. Kraken

In November, the SEC sued Kraken’s parent companies for failing to register as a trading platform. The document also alleges that Kraken’s business practices, internal controls, and record-keeping posed additional risks.

The Commission drew attention to the statement of the platform’s independent auditor, who acknowledged a “significant risk of loss” of client funds. In particular, officials recorded payment of part of the operating expenses from bank accounts where $5 billion belonging to users was stored. Notably, in February 2023, the platform had already settled charges brought by the Commission regarding an “unregistered” staking program.

SEC vs. Hex

In July, the SEC sued HEX, PulseChain, and PulseX founder Richard Heart for alleged sales of unregistered securities. According to the SEC, the entrepreneur raised over $1 billion by selling tokens from three projects (HEX, PLS, and PSLX) starting in 2019. The suit notes that he promoted them “as a path to great wealth for investors.”

The lawsuit, filed in the Eastern District of New York, alleges violations of securities laws. In addition, the Commission also accused Heart of fraud – he allegedly embezzled money from PulseChain investors. In particular, the regulator mentions the rare black diamond, The Enigma. In 2006, it was included in the Guinness Book of Records as the largest cut diamond in the world. In February 2022, Hart announced himself as the buyer of the stone at a Sotheby’s auction for $4.29 million in cryptocurrency.

In December, the SEC said it had begun legal proceedings against the HEX founder, based in Finland. In a statement filed in New York District Court, the SEC explained that the agency previously could not personally serve the subpoena on Heart. The department knew the man lived in Helsinki but carefully concealed his whereabouts.

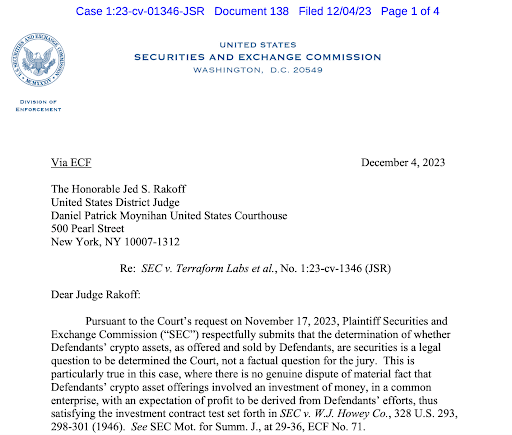

SEC vs. Terraform

In December, the SEC asked the court to clarify the legal status of crypto assets provided by Terraform Labs and determine whether they are considered unregistered securities. The request came before Judge Jed Rakoff, currently presiding over the case against Terraform Labs and its former CEO, Do Kwon.

According to the SEC, the cryptocurrencies Terra Luna Classic (LUNC), TerraClassicUSD (USTC), Mirror Protocol (MIR), and their corresponding “mirror assets” meet the criteria of securities. The regulator justifies its position by pointing to the investment nature of the assets and the profit expected from the defendants’ efforts.

The SEC is pushing for summary judgment, arguing that the facts presented are sufficient to make a decision. The authority expressed concern about a possible repetition of the situation when the simplified decision in the SEC case against Ripple in the summer did not satisfy the regulator.

SEC vs crypto: what to expect next

In 2023, the SEC was highly active in cryptocurrency projects, using enforcement actions and initiating litigation against dozens of companies. Some cases concern real cases of fraud and bankruptcy; others are related to gaps in SEC crypto regulation and the lack of criteria for classifying tokens and cryptocurrencies, further fueling the ongoing narrative of SEC vs. cryptocurrency.

According to the expectations of institutions and many analysts, 2024 should be the year of active market regulation. And while Hong Kong or the UAE creates favorable conditions for the development of cryptocurrencies, and the E.U. is trying to develop unified rules, the repressive mechanism of the SEC, led by Gary Gensler, continues to grow in the United States actively, based on selective and inconsistent application of securities legislation.