Celsius Network (CEL): Banking and Financial Services Platform

Celsius Network, an innovative platform that integrates the most popular banking and financial services, offers additional financial incentives to users who deposit their cryptocurrency as well as utilize additional loan and wallet-associated payments.

What Is Celsius?

The recent developments in the DeFi segment contribute to the growing demand for additional banking and lending services that can provide the proper combination of high returns and sufficient reliability. Celsius has become one of the segment’s leaders in such spheres as loans and wallet-style payments. Regular payouts and comparatively high interest offered to users effectively distinguishes Celsius from its main competitors. At the same time, the platform avoids unsustainable operations or arbitrary tokens’ issuance, thus maintaining the adequate integration of all of its key components in a consistent manner. CEL is a utility token that performs various complementary functions, including additional payout opportunities for network users. Celsius offers the maximum flexibility in terms of calculating returns being offered to users on the basis of their participation in loan and deposit operations.

CEL’s current price is $1,27 with the circulating supply of 238.8 million tokens. Its current market capitalization equals $304.28 million, making it the 95th largest cryptocurrency in the market. Its maximum supply is 695.7 million tokens, while there are only 34% of its supply being currently issued. CEL experienced the steady development until the crypto bull run of the end of 2020–2021. CEL has reached the highest price level of $8.05 in the middle of March of 2021. Celsius proved to be unable to demonstrate similar performance in the second half of 2021. Despite the rapid decline in the following months, CEL has become able to partially restore its positions within the past days after its rapid appreciation and investors’ growing interest.

Figure 1. Celsius Network’s Promotion Image. Data Source – CryptoPumpNews

Investing in CEL: Pros and Cons

The long-term demand for CEL will largely depend on the combination of the following key factors: the rates of the DeFi segment’s development; competition in the lending sphere; and its ability to introduce new features and expand functionality for its users. In any case, CEL will remain highly dependent on the overall trends in the crypto market, and its price dynamics will remain highly correlated with that of BTC, ETH, and other major cryptocurrencies. Technical analysis may be helpful for determining the key short-term levels of support and resistance in the market.

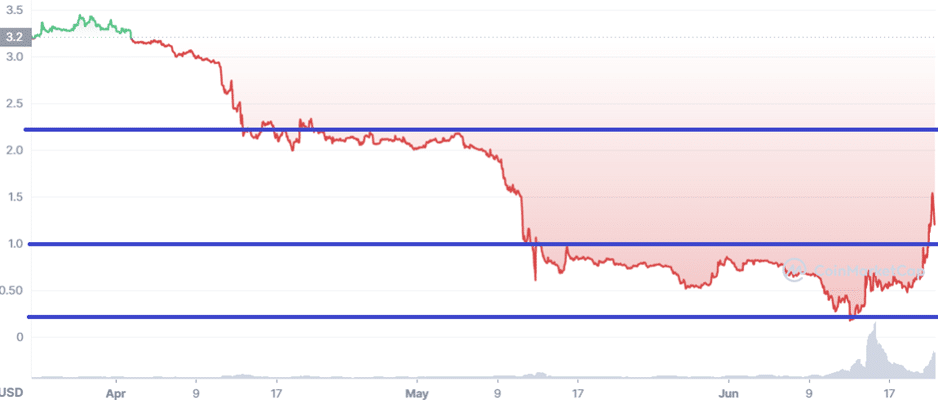

Figure 2. CEL/USD Price Dynamics (3-Months). Data Source – CoinMarketCap

CEL’s short-term price dynamics is characterized by the following two major support levels. The first one corresponds to the local minimum at the price of about $0.25 that enabled the trend’s reversal within the past week. The second one refers to the price of about $1 proven to be historically significant for the token’s growth. The major resistance level is at the price of $2.3 that prevents CEL from appreciating further and reaching historical maximums. Thus, in case CEL exceeds the critical level of $2.3, traders can reliably open long positions with the expectation of the token’s further appreciation in the following weeks.