Can FTX make a comeback after Bankman-Fried’s trial?

FTX’s potential relaunch hangs in the balance as founder Sam Bankman-Fried faces trial, challenging the exchange to rebuild trust and financial stability.

The fall of crypto exchanges isn’t new in the digital assets industry. From Mt Gox to BlockFi, several tier-1 exchanges have filed for bankruptcy over the years, whether it was due to million-dollar hacks, market downfall, or bad strategic decisions. However, almost none of these events were as damaging and crippling for the crypto industry as the FTX collapse.

FTX was a trailblazer, rivaling the likes of Binance in 2021 and poised to become the biggest institution in the crypto industry. But the exchange’s fall was as colossal as its climb. Alleged misconduct and financial mismanagement from its founder, Sam Bankman-Fried, led to the platform’s demise. According to reports, the platform has lost over $8 billion in customer funds and also directly influenced the bankruptcy of several other platforms that were a stakeholder or a lender for FTX.

As Bankman-Fried’s trial awaits its final verdict this week, there are some lingering hopes about FTX’s potential revival. So, will FTX 2.0 emerge from the ashes? This article probes into the feasibility of a comeback, offering a panoramic view of FTX’s potential future.

Understanding Sam Bankman-Fried’s money heist

According to witness testimonies in the ongoing trial, the key issue that drove FTX’s collapse was the uncontrolled use of customer funds for both personal expenses and investments. Alameda Research, which was a separate institution founded by Bankman-Fried, allegedly had an $8 billion line of credit from the exchange. Although Bankman-Fried denied having allowed that credit, his colleague suggested otherwise.

The founder also made several political donations from the platform’s customer funds and sanctioned big loans to his colleagues. According to the testimonies, both he and other employees like Nishad Singh and Gary Wang, as well as Alameda CEO Caroline Ellison, bought properties and real estate with sanctioned loans from customer funds. This led to a liquidity failure when several customers went to withdraw their assets during the crypto winter of 2022.

Complexities beyond the numbers

FTX’s potential comeback isn’t just about being able to recoup enough funds. There are several legal and financial hurdles that would need to be addressed by the current board.

The concept of FTX 2.0 emerged when a revised strategy was announced, targeting the return of 90% of recovered assets to the affected customers. This plan, developed by the newly instated administrator, John Ray III, was to be presented to a U.S. bankruptcy court. However, the proposal doesn’t assure a full 90% recovery, and the actual reimbursement hinges on several variables, including the final approval from the court and the eventual total recovered assets.

The financial challenges extend beyond mere numbers. The policies of U.S. Chapter 11 bankruptcy proceedings require the plan to address several compliance issues ranging from token lockups to strict anti-money laundering procedures. The enormity of the task will require FTX to start from scratch, setting up a robust framework that ensures transparency, regulatory compliance, and, ultimately, the trust of the stakeholders involved.

Also, the narrative of recovery isn’t solely about the numbers; it’s about trust and credibility. AI developers, Anthropic’s share prices increased by over 40% this year after receiving several high-profile funding, including from the likes of Google. As a major stakeholder in Anthropic, FTX might be able to accumulate enough cash flow to pay back its customers.

The board is also negotiating with three bidders to sell its assets and potentially restart the platform. So far, they’ve recovered nearly $7 billion in assets, which includes $3.4 billion in cryptocurrency. These numbers suggest that FTX’s potential revival is significantly feasible, but would it be able to retain and attract new customers?

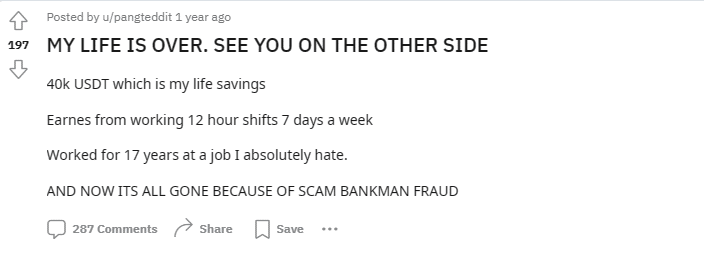

The process of fund recovery itself is long-winded, and the timeline is uncertain. Even though there’s a light at the end of the tunnel with some funds having made their way back to the customers, the complete financial restitution remains a distant milestone. The exchange’s collapse has evidently impacted many lives. There have been reports of community members giving death threats to former FTX ambassadors in Africa. Users who lost their funds have also reported suffering from extreme depression and having suicidal thoughts. So, even if the funds are recovered and compliance is guaranteed, it would be a herculean task to achieve customer trust for this brand.

How does the FTX saga compare with previous bankruptcies?

The situation at FTX isn’t unique in the crypto industry. Other exchanges have faced similar crises but with varying outcomes. A comparative lens sheds light on how different platforms navigated through their challenges and what FTX might learn from them.

In 2016, Bitfinex suffered a major hack, resulting in the loss of 120,000 BTC. Unlike FTX, Bitfinex managed to stage a comeback by issuing a token to its users equivalent to their lost funds, which could later be redeemed or traded. This move not only helped in retaining user trust but also in recuperating lost funds over time. However, this wouldn’t be a practical solution for FTX, as the platform had already issued a token, FTT. Under the current restructuring proposal, FTT will no longer exist, and its holder won’t receive any fund distributions.

The infamous collapse of Mt. Gox in 2014 due to a hack stands as a stark contrast to Bitfinex. Despite ongoing efforts, the full recovery of lost funds remains elusive, and the lengthy legal proceedings have left many users disillusioned. The 2019 debacle at QuadrigaCX, triggered by the mysterious death of its CEO and the subsequent loss of access to user funds, also highlights the complex challenges in asset recovery and the crucial role of regulatory oversight.

The contemplation of FTX 2.0 is as much about rectifying past mistakes as it is about adapting to the present and envisioning a future where the exchange operates with enhanced transparency, security, and user-centricity. The journey towards FTX 2.0 is a complex one, filled with uncertainties, but with a carefully crafted strategy, it could mark a new chapter in FTX’s narrative. The company is set to make a decision regarding its future in mid-December, as revealed by its investment banker, Kevin M. Cofsky. It’s likely that the decision will hinge on Bankman-Fried’s verdict and ongoing community sentiment towards the brand.