Forget Sandbox’s, SEC Commissioner Peirce Proposes “Bitcoin Beach”

For many in the regulatory space, the question of cryptocurrencies and how to manage them is seemingly black and white. Some are either very pro and have quickly jumped on the bandwagon, while others are content to ban, block, and forbid any further discussion. In a May 2, 2018, speech to her colleagues, however, SEC Commissioner Hester M. Peirce revealed a much blurrier distinction. In an open-minded and inquisitive presentation, Peirce explained the difficult challenges of “the creative heart of the financial world” and that which looks to cultivate innovation as well as protect interested parties.

Nascent Vocabulary

The idea behind a regulatory “sandbox,” something we’re seeing spring up all over the world these days, is highly-attractive for a couple of reasons. First, the emerging crypto economy and distributed technologies are very new, volatile, and full of never-before-seen problems. At the same time, this novelty is coupled with alternative solutions to problems we have been facing since the arrival of the internet.

Wholly unfamiliar financial instruments can now be created in order to match our digital migration better. Trendy concerns about what really happens to our data can be resolved by adding a blockchain (a private or public rendition is, well, another story). Programmable money, of which we can send values in the millions in seconds flat anywhere in the world, opens up huge implications for the financial sector. In general, these new achievements in the field of law, healthcare, entertainment, and publishing mean some serious re-thinking.

So how can you minimize the obstacles and maximize the technology? With a sandbox, or as Commissioner Peirce amends, “a beach.”

Hester Peirce SEC Image (Source: SEC)

A sandbox is basically a safe space where innovators, entrepreneurs, and regulators can work together on projects in a certain sector. It helps to break down the Us versus Them barriers on top of which the crypto-anarchist ethos of early-founders built their ideas. It also means a degree of transparency that keeps innovations from being smothered outright. More importantly, it opens the channels of communication between a number of important agents in the cryptosphere.

Fortunately, lawmakers like Commissioner Peirce are taking this process pretty serious. In her speech at the Medici Conference, she astutely points out how things like bitcoin pose existential threats to the very nature of money. The Commissioner stated “It’s money not because of its form, but because of its function” and that “such an analytical approach—defining an instrument by its function, not its form—can be useful when we’re confronted with something that seems entirely new and difficult to categorize.”

The honesty in which a regulator is dissecting cryptocurrencies from a financial perspective is indeed soothing. Yes, these are strange and new and sometimes consume huge amounts of energy, but it certainly seems like they deserve some serious attention. Peirce continued:

“The tokens we’re all so interested in these days aren’t metal and don’t clink. Instead they are [what], exactly? In metaphysical terms, they are sometimes talked about as if they are the gateway to a future that challenges well-established past norms. In physical terms they’re a set of code. In functional terms, well, it depends. And that’s the challenge.”

Now, we have code that serves as money, and this money can be programmed to do things money has never been done before. Sometimes it behaves as currency, sometimes as a commodity and sometimes as both. It also feels like we’ve only just begun determining what these instruments can actually do:

“Then there are utility tokens that are designed to function much differently, at least at some point in their lifecycle. These tokens may function as a means of executing a transaction, as a way to get access to a product or service or participate in a community, or in any number of ways that have yet to be dreamed up.”

Thus, a problem of vocabulary is emerging. We don’t really know what to call these things because we still don’t really know what they can do. From a legislative perspective, this is a big problem.

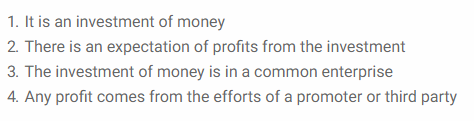

Initial Coin Offerings: Howey Says Security

Brief history lesson; in 1946 there was a court case between the SEC and W.J. Howey Co. regarding how best to apply federal securities laws to the sale of service contracts for an orange grove. More importantly, it has become the de facto reference case when dealing with future securities determinations, even Initial Coin Offerings (ICOs) in 2017 and 2018.

Howey Test Image (Source: FindLaw)

Further to that, the Howey case identified a security as “an investment in a common enterprise with the expectation of profits solely through the efforts of another.” Sounds a lot like the idea behind most offerings for new distributed networks. All these “shitcoins” and “unicorns” alike sell investors on a “moonshot” or a massive return on investment for their participation.

The problem with this sort of cut-and-paste regulatory stance, especially when comparing laws from the 1940s to emerging technology in 2018, is that we may be curbing innovation potentials we never thought possible. Peirce puts it so:

“If the coins offered in ICOs are designated as securities, for example, their development and the development of their offerings will track the contours established by the relevant securities laws and regulations. They will, over time, come to look more and more like securities and securities offerings. Innovations that might otherwise have occurred that don’t fit within that ‘security’ framework may never come to fruition.”

By confining ourselves to specific frameworks (i.e. “sandboxes”), we may never end up seeing an idea’s true possibility (i.e. “beaches,” “oceans,” etc.). There, however, are also limits. We needn’t destroy everything, adds Peirce. While innovation is critical and can often improve the quality of life for those who participate in its benefits, a regulator’s job must also include the harmful effects the innovation may portend. It’s a double-edged sword indeed, but Peirce admits her ambition to overcome the “steep learning curve ahead.”

My epic list of Bitcoin resources has moved to https://t.co/d2FH36KLv2 & is open source! Submit pull requests here: https://t.co/LY4x9wqVZs

— Jameson Lopp (@lopp) August 17, 2017

Two main points, then. Regulate without fear, but don’t be heavy-handed. Seems quite simple, right? Not so fast. After this balancing act, a regulator also faces a third potential trap according to Peirce. In this sentiment, we glean the most eloquent aspects of the Commissioner’s mental model for thinking about things like blockchain technology and cryptocurrencies:

“The regulator may insert itself inappropriately into the creative process. The regulator should be careful not to try to control the development of new technologies. Not only is it outside the regulator’s proper function, but such micromanagement can result in the regulator forcing new technology to fit existing—and familiar—regulatory frameworks regardless of whether those frameworks are appropriate. The law deserves respect, but technological progress should not be bound by the limits of the regulator’s lawyerly imagination.”

Peirce, in so many words, is describing the hearth of creativity. She is approaching financial regulation in the same way that crypto assets and their financial potential are reshaping pre-2008 monetary thinking. The Commissioner is aware of old-helm policies and how their framework may not be able to fully encompass things like Ethereum or Filecoin or 0x. In this way, perhaps our leader (on the side of the government) should be Peirce rather than Giancarlo.

Concluding, this is pretty good news for us in the crypto space. It allieves fears of a secret blanket ban and, if innovators are as curious and courageous as Commissioner Peirce, opens wide channels of communication. With regulation sure on the horizon, we should feel more confident that our crypto-technological ambitions are being due justice. We may even learn a thing or two.