How to Be Short Shitcoins and Long Trading with Bitcoin Evangelist Tone Vays

BTCManager spoke with Tone Vays and all things surrounding Bitcoin outside of its price. The teacher turned corporate financier turned back to teacher, blockchain consultant, and budding carnivore has had skin in the game long before Nassim Nicholas Taleb’s series of novels. The route to ~166,000 Twitter followers and becoming a master node of knowledge in the crypto game, however, has been far from traditional.

Since earning a bachelors in mathematics and geology from the State University of New York at New Palz, he became a high school teacher in New York City. Fortunately for the crypto community, the role didn’t really stick.

From there Vays got a Masters in financial engineering from Florida State University and then moved from Bear Stearns (pre-crisis) to JPMorgan (post-crisis) and got a front row seat into the great system of IOUs that is the world’s financial system. Now, he’s on the side of finance trying to reinvent the wheel with Bitcoin, and only Bitcoin.

An uncompromising purist, Vays explains in the following interview his distaste with the altcoin market, Bitmain’s shady business practices, as well as his attempts at living like a true carnivore (hint, it’s tricky). All of it insightful and none of it financial advice.

The following interview was conducted during The Hackers Congress held at The Institute of Cryptoanarchy from October 5 to 7, 2018. You can find BTCManager’s coverage of the event here, here, and here.

Q & A with Tone Vays

While you’re certainly knowledgeable on a number of other items, I think many people do follow you based on your reputation as a trader. With a background at JPMorgan and a few other more traditional financial institutions, what got you hooked on trading cryptocurrencies?

I have a background with JP Morgan and Bear Sterns before that. I was first hooked on trading and technical analysis since before my very first job. I learned how to trade in 2004 and my first Wall Street job was in 2007, but my job there wasn’t trading, but building risk models for hedge funds. I always wanted to be a trader though, and I eventually quit my job to be a traditional trader in 2015. Even before that, I was already in love with crypto, but mostly Bitcoin.

So, all of my experience was in trading traditional assets and even when I started trading crypto, I didn’t like trading crypto. I didn’t trust the exchanges and I didn’t like the illiquid markets, so I only traded for a little while.

Even today, the only trading I do is on the traditional markets, but I teach people trading because I have a big background in education. I like trading and I’m good at explaining things and in the crypto space I found a niche market where people are traders, but they’ve never “learned” it.

I’m able to almost dominate the crypto-trading-education market with all of my experience and skill set. But as far as “what do I trade,” I still trade traditional assets because I feel that I can make a better return. Or, not necessarily a better return, but its a better risk-reward ratio. I can trade the traditional markets in a low risk way and I make a good enough return that I don’t have to add more risk to have a higher return in the crypto space.

The skill set that I teach is across all assets, not just crypto. It’s just that my clientele tends to come from the crypto space.

Why do you think that is?

Because all of my videos are on my love of Bitcoin, my explanations of blockchain, and covering blockchain news. I do all of this because you can’t monetize that content. So, coming to conferences and speaking is so that I can spread the knowledge of Bitcoin, but I make money from what I do best, which is trading.

It’s a skill versus a hobby kind of thing.

Right. My skill is trading and I can teach trading, but my passion is Bitcoin evangelism. I am able to monetize my evangelism by educating traders in the crypto space.

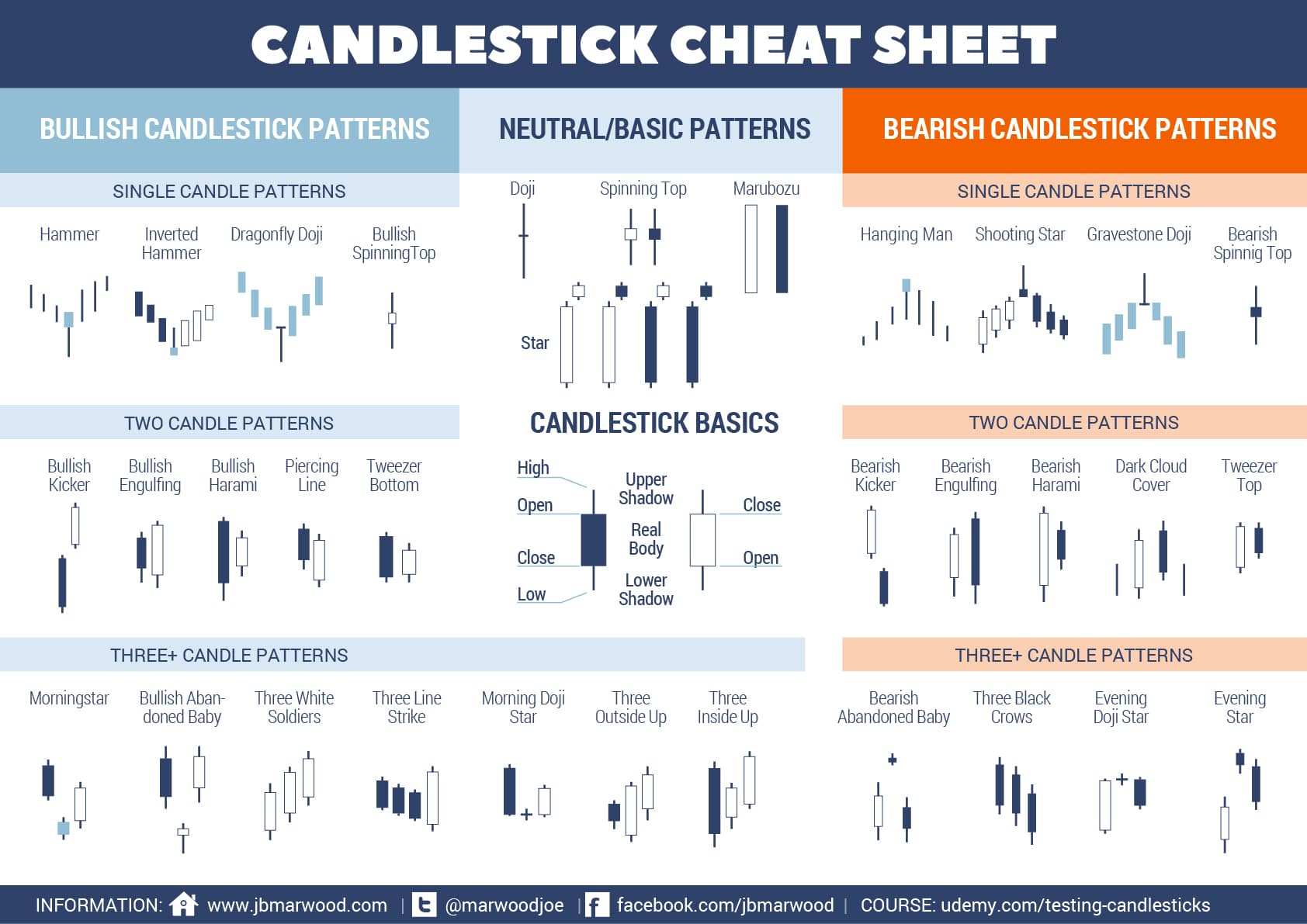

Going off of this education aspect, what kinds of resources are you giving to different types of traders? If we’re to imagine three tiers of traders, what kind of resources would you prescribe to someone coming from the traditional stock market business to crypto?

If a person has experience in trading traditional markets, there isn’t a whole lot of additional resources I can give them. If anything, I have to warn them that when you trade traditional markets, the one thing you don’t have to worry about is your funds disappearing. But in the crypto market, that’s a risk.

The other day, an exchange called 1Broker got taken down by the U.S. government and I had some bitcoin on that exchange because I used to trade there. I still had some on there that I’ve always been too lazy to withdraw, and now it’s gone. That’s the risk of a government deeming that exchange illicit and confiscating the funds.

Then you have external hacking that can happen, and you can even have internal hacking, like an employee running off with the funds. These are the risks that a traditional trader doesn’t have to worry about. I don’t have to worry about my exchange with my retirement fund running away with my money, that just doesn’t happen. Sure, there’s a risk of government confiscation, but it’s a lot smaller in the traditional environment than in the crypto environment.

As far as the trading skill set goes, I introduced a very popular Wall Street indicator. It’s called the TD Sequential and it is something that professional traders use, but not amateur traders. The reason is that it’s a very expensive and licensed indicator where, as far as I know, the only place you can get it, unless you want to write the code yourself, is through the Bloomberg Terminal.

Like proprietary software?

Well, yeah. The Bloomberg Terminal is just an expensive terminal. A Bloomberg Terminal gives you so much information and a portion of that information is this indicator. Unless your willing to spend $3,000 a month on a Bloomberg Terminal, you just have no access to this one particular indicator. Because of that, there are very few people that know how to trade it. They’re just the top-notch professional traders. These people that know how to trade it, they’re not in the business of education. They’re in the business of sitting at home and trading.

– TD Sequential Bear Wave fully completed.

– Second time on #Bitcoin existence that this happens.

– This week opening with a new TD Seq Bull wave. pic.twitter.com/j1YMUEL0XM— Crypto Rand (@crypto_rand) July 16, 2018

I believe I introduced this indicator to the crypto traders and now I’d say a good 20 to 30 percent of all of the Bitcoin traders, are somewhat paying attention to this indicator that they would’ve never heard of. I am probably the best, if not the only resource for, not only crypto traders, but also traders with traditional trading experience to learn how to trade this particular indicator.

Now, if they want the actual version to appear on their chart, they still have to pay that $3,000 to Bloomberg, but at least through me, they’ve learned how to use it.

So, they get there’s money worth when using this software.

They’re going to get their money’s worth regardless. But the math of the indicator is public knowledge and I’ve coded it for TradingView, which is my charting software along with most people in crypto. Others have coded it too, so now, there are dozens of versions of this indicator. Some are coded better than others. I only trust the one that my developers coded, but anyone can code it, but I’m the one that introduced it to this space. Otherwise, no one would of heard of it because maybe less than one percent of all global trading uses it.

But I believe it’s the most accurate indicator there is. And I’m kind of proud of introducing this method of trading as it has given me some kind of expertise. This is why people continue to show up at my workshops to mostly learn this indicator along with my other knowledge of trading.

(Source: Tone Vays)

And speaking of these two other tiers of person interested in trading cryptocurrencies, would you prescribe this indicator to someone just getting started?

It’s a very advanced indicator. However, just because it’s an advanced indicator, it doesn’t mean that you should not be learning the basics of trading with that indicator alongside helping you. For example, when I was learning trading in the early 2000s, within six months of learning that trading even exists, I learned how to trade options.

Options trading is probably the most advanced and most dangerous trading you can do in the world.

It’s like one step shy of crypto.

No, it’s even worse. Except the money losing part. Options are what almost took down the financial system in 1992 with the long term capital management. The whole financial industry had to bail out a hedge fund that was being run by nobel prize economists who invented the option pricing model.

They almost took down the whole financial system with options. Options are a very dangerous tool that I don’t recommend anyone trade, but I learned it within six months so my trading, all of my trading, has been focused around options.

Regarding the TD Sequential, just because something is advanced and complicated, it really depends on the person. While I caution people to know exactly what they’re doing in trading, learning the most useful tool in the beginning is not necessarily a bad thing. It could get you going in the right direction from the start.

When you’re looking to evaluate trades along these vectors, you’re looking at charts and you’re basically crunching numbers. But when you’re investing from a more long-term perspective, you’re looking at a much different set of information. Basically, how a coin is functioning. People will trade shitcoins regardless if it’s good tech or not; because it’s pumping or dumping. But when you’re thinking about these longer term investments, especially considering your experience in risk management, what kinds of things are you looking at?

This is an interesting question. To me, fundamental analysis ends with Bitcoin. There are projects, rather than tokens, in the crypto space, however, that I do find long-term good investments. For example, Bitfury. I think Bitfury is a great company and I think they’re going to continue to do very well.

If you're a journalist covering this industry and you want to recover some of your lost moxie why don't you write a story about the neverending parade of forks from the ZCL crew which are used to catalyze pump and dumps. That would be socially useful

— nic cartel ᵍᵐ (@nic__carter) April 28, 2018

What do you mean by “fundamental analysis ends with Bitcoin?”

The long-term viability. I believe that Bitcoin is the only token that is long-term investment grade quality. Everything else, every other token, from litecoin, monero, on down through your ICOs, I think all of them are short-term penny stocks. I would never hold my value in any of those coins. Perhaps, for seconds at worst and a couple of months at best.

That being said, I teach people that you can trade anything you like. But if you’re going to put your money into a long-term hold, the only token in the crypto space that you can do that with is bitcoin. Now, because of my travel schedule and because I don’t trust exchanges, I decided to have a long-term outlook on bitcoin. Even though I’ve been bearish on the price of bitcoin and predicting sub $5,000 prices since January 10 of this year, I’m still holding onto most of my bitcoin. My time horizon for bitcoin is multiple years down the line.

So when did I turn from #Bitcoin BULL to a $BTCUSD Bear?

Looks like it was January 11th, 2018 (w/ caution statements as of Jan 9th & a Short Trade suggested on Jan 10th). Been looking for $5k 1st Target ever since.

In hindsight, wouldn't re-word a thing from back then. pic.twitter.com/nYEM4oVjGc— Tone Vays (#Unconfiscatable Conf March 3-6) (@ToneVays) October 2, 2018

I did sell a little bit of my bitcoin to pre-pay some of my bills for the year. However, my long-term view of bitcoin makes me comfortable to hold on and see its fall in value. I just don’t see that from any other token.

Outside of cryptocurrencies, are there other sectors of this community, such as mining or security, that you also think are important because they’re solving real problems?

Mining companies could be very successful, you just have to pick the right mining company. I think Bitmain is problematic, I would never invest in them. But, Bitfury and Avalon [Canaan] seem to be very good companies.

Why wouldn’t you invest in Bitmain?

I think Bitmain is playing lots of accounting tricks and I think they’re $1,000,000 Bcash (BCH) position is a huge problem. They have done a lot of unethical things in the marketplace.

Are you referring to their attempts at cornering the market?

It’s not about cornering the market from a hashing power perspective, it’s about all the rumors I’m hearing about them squeezing suppliers and competitors. Also them having ASICBoost and mining in a way that was deemed unethical in the community which they had kind of a gentleman’s contract, but they broke it.

They won’t cooperate well with their competitors. There are just lots of other shady practices that are going to cause them a lot of problems. They’re leading chip developer has quit to start a competitor, and when you lose your number one engineer and he goes and starts a competitor, that’s a big problem for your company.

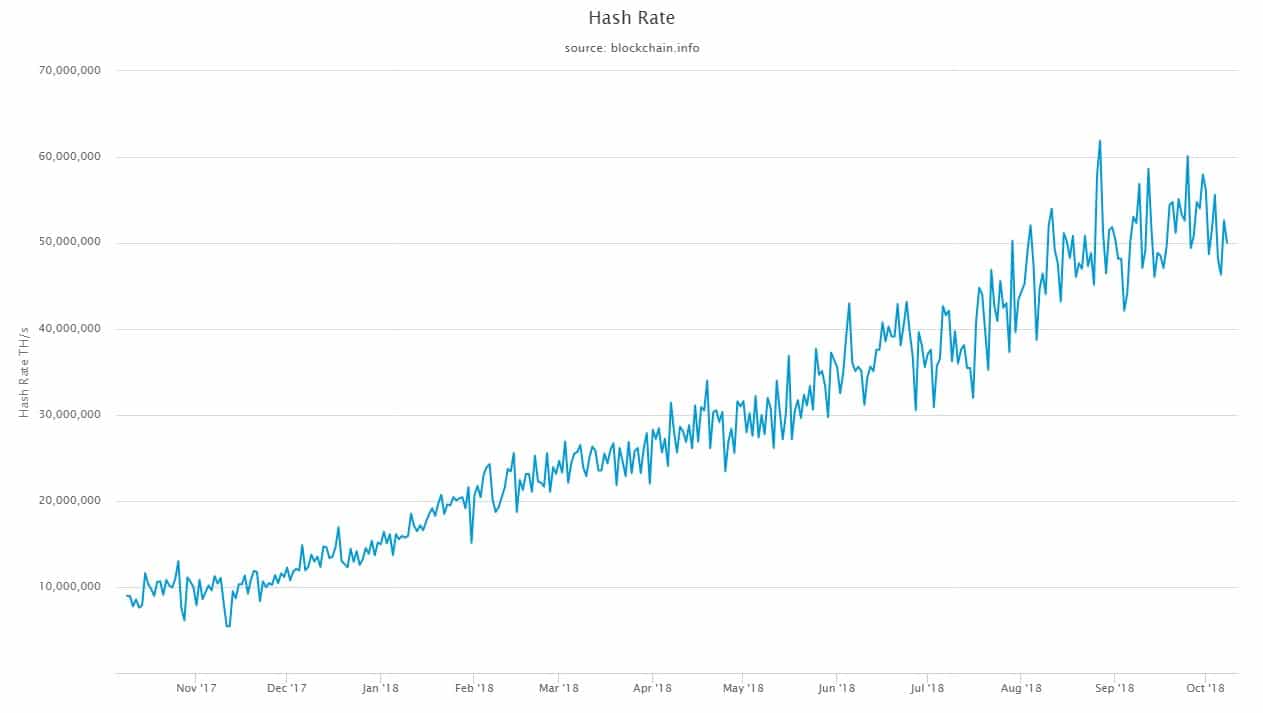

Bitcoin’s Hashrate at time of press.

(Source: Blockchain)

So, I think Bitmain is a very bad investment and their biggest innovation was the supply chain, it wasn’t the ASIC chip. This is why Bitfury is a much better investment. Also, traditional companies like AMD and Nvidia are interesting investments.

Hasn’t Nvidia decided to stop pursuing cryptocurrency mining?

It was no longer viable because the price of bitcoin has dipped, but we’ll see what happens on the way up. It’s also to Nvidia’s advantage to say that while they’re working on some good R&D in the background until they suddenly launch something. You have to be careful what these companies say publicly.

Good point.

With mining and chip manufacturing, if you properly research the companies, you can do well. I think that companies involved in research and development of hydrology, cooling, and vent routing are also interesting. These mining operations need that. Energy companies, renewable energy, and the cheap sourcing of energy. These are traditional companies that could benefit greatly in the near future, and if you properly choose the right company, that could be useful in the mining of bitcoin. That could be a great traditional investment.

But all of these companies or sectors that you’ve mentioned hinge on the success of this asset [Bitcoin].

Of course. They hinge on the success of bitcoin. Also, what I thought might happen, but it doesn’t look like it is, the exchanges in the crypto space could also be a good investment. Current exchanges are still amateurish, but the idea is, Netflix is just Blockbuster, but on the internet. But they did it so well that they took Blockbuster out of business of bringing movies to your door.

I don’t think this is going to happen, but it’s an idea: When you have a crypto exchange that has hired the brightest people in order routing and order matching, and that exchange has the best technology and that exchange is making lots of money, they can then bring that technology to the traditional exchanges. If Coinbase, for example, did the right things and they had the right engineers, we could’ve seen a future where Coinbase had bought the NASDAQ, could’ve bought ICE which owns the New York Stock Exchange.

But because the crypto exchanges did not step up, they missed their opportunity. Crypto chip manufacturers, like Bitfury for example, have a chance to take out IBM, take out AMD, take out Nvidia, and be a top five company in the world.

As chip makers outside of cryptocurrency.

Correct. The more money you make, the more innovation you have, the more talent you get out of college, and the more you can branch out the better. Amazon started selling books on the internet, and now their dominating web services. Who would’ve thought? They’re challenging Netflix for movie streaming now. They’re challenging music streaming. It is really about how much money you make from your core business and where you branch out.

Crypto exchanges could’ve had a chance to be something massive that took over traditional markets, but now it looks like it will be the other way around. But, there’s still time. You just need to look at these other industries that could potentially grow out of that crypto space and dominate the traditional space.

Everyone seems obsessed with this narrative that bitcoin is so terrible for the environment, but what’s not being talked about is this parallel movement of making green energy to mine bitcoin.

Correct. A lot of people are missing the fact that the hunt for the cheapest, most efficient electricity to mine bitcoin is going to benefit the whole world. And a lot of people miss that. There isn’t a need for renewable energy until you have an advantage on mining bitcoin.

It’s like the ultimate incentive.

Just like how the price of oil goes up above $100 a barrel, solar power does well because people look for alternatives. And every time oil drops to $20, no one cares about solar power because their energy is cheap.

So we have mining communities, green energy communities, exchanges, who may or may not have missed their boat, but what about in the field of hardware?

It’s difficult for a hot wallet in your cell phone to make money, but the cold storage ability and the innovating in people’s preservation of bitcoin, that is monetizable. Hardware wallets and other custodial solutions that give that person the power to be their own bank, those could become very powerful and very profitable. It’s also, very challenging.

Bitcoin does certain things well. Bitcoin is the first un-confiscatable asset the world has ever had if properly secured. Bitcoin is censorship-resistant value transfer, which doesn’t exist in the fiat world, unless it’s hand-to-hand transactions. And Bitcoin has a hard monetary policy that is similar to gold and pretty much unchangeable.

But Bitcoin still struggles with transaction speed, transaction costs, even though it’s much better than last year, and fungibility, which is privacy. But there’s a road map and within the next two years, Bitcoin should have very fast, very cheap, and way more private transactions.

You mean with MimbleWimble and this kind of thing?

More like Schnorr Signatures and Bulletproofs. MimbleWimble is a little tricky technically. Lots of solutions in any case, lots of great things on the horizon. But Bitcoin still struggles with volatility, it’ll take many years for the value of bitcoin to rise enough so that your small transactions are not volatile in price.

Also, Bitcoin security is a challenge. In order to make it un-confiscatable so that you don’t lose it, there’s lots of innovations that still need to happen. It has to be way more user-friendly and I think there is money to be made there for the people that can solve the storage challenges and custodian challenges.

What happens when you die? What happens to your bitcoin? Mine is gone forever. How about you?

Yah, if I die my bitcoin is probably lost.

Exactly and these are the challenges that still need to be resolved and there is money to be made in solving these problems.

As my final question, do you consider yourself a carnivore? Are you only eating red meat?

I am doing my best! Before I got into bitcoin, my hobby was diet and exercise.

Chicago Bitcoin carnivore dinner after my talk on August 11. Sign up here if interested:https://t.co/zYg2kXJo7N

— Saifedean.com (@saifedean) July 30, 2018

Like Strongman competitions?

Just more like looking good and feeling healthy. Competitions were like Tough Mudder or an obstacle challenge. I was playing competitive sports.

What did you play?

Volleyball mostly, but also baseball and softball for fun. I have also tried to keep my diet in check and to stay in shape. And I’ve always been a big fan of the Paleo diet because it did very well for me. And recently, I’ve been doing my best to be a carnivore, but it will take time.

As someone who is an omnivore and who even enjoys eating vegetables, this is crazy. You’re going to get scurvy.

There’s two things. Being a carnivore is sustainable and not health dangerous. The challenge is actually doing it. Eating only meat, and only red meat, can get boring, and while it’s easy to cut away vegetables, I still like my fruit and I still like my alcohol.

No alcohol either?

If you’re a purist, no. I think it’s a way for me to try out certain diets and eventually, in my next life of hobbies, I will design my own ultimate diet plan somewhere between Paleo and carnivore. Keep an eye out for the Tone Vays Exclusive Diet.

Loose Ends

Concluding, BTCManager inquired about some outside reading and the philosophical basis for Vays’ bitcoin push. Naturally, Saifedean Ammous’ book The Bitcoin Standard and anything revolving around Austrian Economics came highly recommended.

You can’t counterfeit #Bitcoin. It’s the only perfect hard-money medium of exchange humanity has ever encountered. To own some – is to declare freedom from tyranny, governments, while declaring sovereignty-of-self. @CryptoSprings pic.twitter.com/eD9vVlqBaU

— MAX (@maxkeiser) August 8, 2018

After that, he explained his debt of knowledge to Martin Armstrong and Armstrong Economics for providing a “high-level outlook on how markets work,” and openly regretted not having yet read the entire blog. Finally, he gave a big shoutout to Max Keiser for putting “Bitcoin in [Vays’] head.”

For more information on the life and times of Tone Vays, readers can also check out his blog LibertyLifeTrail which dives into sovereign thinking and the promotion of an independent lifestyle. After that, Tone Vays Trading delivers content on trading strategies, workshops, and consulting opportunities.