Ten Years after Lehman Brothers Sunk, Wall Street Comes Full Circle on the Back of Bitcoin

Ten years after Lehman Brothers filed for bankruptcy in 2008, a host of new financial offerings is hoping to entice sullied investors back into the market. The task hasn’t been easy, however. The financial crisis that spawned Bitcoin has left enough emotional damage to keep those with a keen sense of memory far from equities and traditional stocks. This same adversity has also pushed millennials into the arms of products far outside the realm of conventional banking: Cryptocurrencies.

The Bigger They Are, the Harder They Fall

On September 15, 2018, Lehman Brothers Holdings Inc. filed for Chapter 11 bankruptcy protection sparking the financial world’s descent into the 2008 crisis. At the time of filing, the investment firm reportedly held $600,000,000,000 in assets and has thus been the most significant bankruptcy filing in American history. Shortly after, fears turned to reality as the world earned a front row seat to the dismantling of our hyper-connected financial system. Deplorable bailouts from government officials also saw the same CEOs who invented the catastrophe walk away with millions, if not billions, in their pockets.

https://twitter.com/el33th4xor/status/1039585514553335809

Skipping ahead ten years later, and many still tremble at the thought of putting their money back in the hands of bankers and the emotional effects of the housing crisis a decade ago are now measurable.

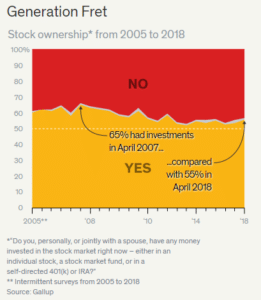

Despite market conditions, which for the most part remained positive, investment in both stocks and equities has dropped significantly. People simply aren’t turning to these instruments anymore. According to a Gallup poll, 65 percent of investors queried in 2007 owned stocks, but by 2018, this figure tumbled a whole ten percent. This neglect has all been in spite of a market that has returned all value lost in 2008, plus a heap of change.

(Source: Barrons)

“People who aren’t saving and investing don’t know that they just missed out on 200 [percent] returns over the past decade,” the director of behavioral finance at Betterment Dan Egan told Barrons. “They’re probably going to continue to not save and invest in the future.”

Finance 2.0, Challenger Banks, and Bitcoin

In their place, a new wave of consumer-oriented banking has emerged. Challenger banks like N26 and Fidor in Germany, for instance, have merged technology and financial solutions to help fill market sentiment. In June 2018,

Fidor also celebrated their five-year partnership with Bitcoin.de, a bitcoin exchange, where they announced the launch of a new crypto-to-fiat debit card from Mastercard. All of this rings familiar, and the stepping stones to a Wall Street 2.0 are easy to map out.

Loans, credit, trading, crypto-exclusive interest rates, and all the financial apertures from the last decade are being lightly touched up for their blockchain buzzword unveiling. Arguably, this change would have inevitably happened in a society so smitten with technology. The slow financialization of cryptocurrencies does seem a bit hypocritical though.

Bitcoin is the real Occupy Wall Street.

— Defend Assange Campaign (@DefendAssange) December 15, 2017

Shades of legacy financial institutions are now very black and white. Any journalist worth their digital ink can follow crypto Twitter for the emergence of Bitcoin ETFs, fully-auditable stablecoins, and the rise of “crypto banks.” The constant reference to institutional investors brings to mind an impending stampede of gray suits chomping at the bit for regulation so they can rush the market with their sidelined trillions.

What’s more, everyone seems more than eager to unlatch that gate no matter the compromise.

The championing of custodians and renouncing control over private keys to intermediaries is worrisome. Existentially, bitcoin was designed to operate without any of these items and will likely continue doing so no matter market conditions. So, what will be the trade-offs for crypto’s next ticket to the moon?

Money Is Money

No matter how observers cut it, evidence points to a preference for a $20,000 bitcoin over hygienic and transparent practices from the Bakkts, VanEcks, and the Coinbases of this novel economy. Incessant money making, whether digital or not, is far beyond the scope of this technology. Moreover, when scanning over the changing narrative, it looks like many have given up on these goals.

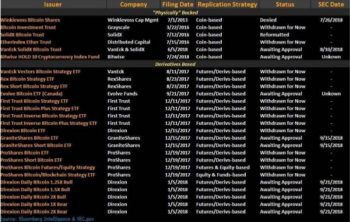

List of Bitcoin ETF applications compiled by Bloomberg Intelligence and the SEC.

(Source: Medium)

Specifically, this has manifested itself in a handful of recent news events. In the first, ShapeShift’s about-face on transparency and a warm embrace of KYC and AML regulations. Their membership program, of which requires users to hand over personal information and will soon be mandatory, runs head-on with CEO Erik Vorhees’ stance just a few years ago.

Next up are the wave of synthetic bitcoin products on offer from Wall Street. Morgan Stanley, Goldman Sachs, and Citigroup all announced a string of different artifices built on the backs of CME’s and CBOE’s futures contracts. While there are distinctions between a swap, a non-deliverable forward (NDF), and a digital asset receipt (DAR), the intention is all the same.

Institutional investors and the oceans of wealth they represent are looking to reduce as much risk as possible when working with cryptocurrencies. Moreover, Wall Street firms also work closely with insurers, almost by default. As a crypto-native alternative is far from even a beta launch, legacy modules of financial insurance and insurable products are still needed.

Ultimately, the economic revolution still has a few years to wait until the upheaval of corruption arrives. Likely, though, upheaval seems like a much lower priority in Q3 of 2018. The name of the game is now to play nice.

Paxos and Gemini both simultaneously launched their stablecoin following approval from NYDFS. A closer look at the Winklevoss Twins’ creation reveals perhaps the most anti-sovereign exchange of value that the crypto space has ever seen. Blockchain researcher Alex Lebed explained in a September 11 Medium post that:

“The current implementation gives Gemini the ability to freeze any account or make all tokens non-transferrable. The custodian is able to completely change the implementation of the token every 48 hours.”

Gemini’s centralized GUSD ultimately returns power to custodians and will likely spark interest from other central banks pending the stablecoins performance and uptake. Any rendition of a private blockchain, viewable only by stakeholders, is sure to attract attention from large multinationals. Ironically, a centralized version of this exact intrigue already exists,and so the paradoxes continue.

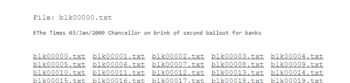

Keep these developments in mind and then have another glance at what Nakamoto inscribed on the genesis block. It’s certainly the end of one era and the rise of another.

The creator of Bitcoin set the political stage for the pioneer cryptocurrency with this phrase.

(Source: BitcoinStrings)